前

Opening Keynote Address by Wong Kim Yin, Managing Director, Investment, at the Power & Electricity World Asia 2010 Conference

Singapore

Revovering from the Global Economic Recession – Opportunities in the Power Sector across the Asian Region

Introduction

Good Morning.

- It is a pleasure to be here this morning, meeting old friends, and making new ones. For those of you whom I have not met, I have spent a number of years with AES, a power company based in US, focusing on business development in Asia.

- Over the past 6 years, my role with Temasek Holdings has been in investments and asset management, mainly in the energy sector. Recently I have taken on the role to lead the group covering infrastructure and transportation.

- I was asked to speak on the topic “Recovering from the global economic recession – What are the opportunities in the power sector across the Asian region”.

- Clearly, the robust outlook for Asia’s economic recovery & growth suggest strong demand for infrastructure. Increased awareness for sustainable development and the desire for a green environment have opened opportunities in clean energy solutions and their derivatives.

- Many in this audience are very well-informed and updated on these themes. I shall hence focus on two other topics that have emerged since the recession.

- The first area I would like to touch on is financing.

Financing

- Markets appear to have stabilised from the upheavals in 2008/9. Equity markets, for instance, have regained much ground since the crisis.

- In the case of debt markets, however, I have observed some significant shifts.

- In China & India, while projects continue to be financed, sources of funding, however, are mainly domestic. It is unclear if these sources will remain available, without government stimulus.

- Other than in China & India, the cost of project financing has increased, and international banks’ appetite to underwrite has diminished significantly, compared to pre-crisis levels. In Australia, for instance, banks are reluctant to offer tenure greater than 5 years.

- Investors of infrastructure have to grapple with the risk of financing long term assets with short tenure loans. They seek higher risk premium to compensate for the additional risk. They also seek alternate sources of financing.

- Capital markets offer an alternative to traditional financing. We have observed many bond issues. Likewise, equity offerings through the public markets are a viable option.

- Infrastructure funds have been tapped extensively in Australia. Painful lessons were learned, on risk management, governance and alignment of interests between management and investors.

- While investors remain wary, they are supportive of companies with good quality. SP Ausnet, for instance, has traded relatively well, reflecting investor’s confidence.

- In Singapore, the business trust market remains relatively untapped, for the purpose of financing infrastructure projects. This could be an attractive base to raise capital to finance projects in Asia. Allow me to elaborate.

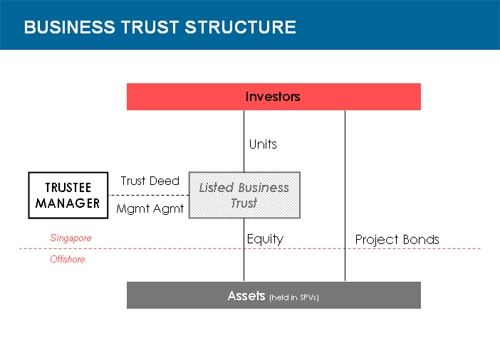

- The slide [Slide 1] shows a typical business trust structure in Singapore.

- Assets, typically held in a Special Purpose Vehicle, are organised under a trust. Investors are trust beneficiaries.

- The Trustee Manager manages the assets under a trust deed and a management agreement. The structure enables the divestment of the assets, while keeping management control with the Trustee Manager.

- Another key feature of the business trust relates to distribution of cash. Distributions are made from cash flows; they are not constrained by accounting profits. That improves the distribution profile of the assets.

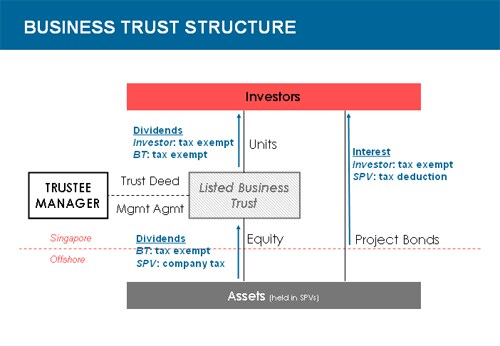

- Next, the tax framework.

- Distributions from the business trust to investors are tax exempt.

- There is also a suite of tax incentives, including concessionary tax rate for the Trustee Manager, and the waiver of stamp duty for transfer of assets.

- The tax framework enables the sharing of tax advantages, hence lowering cost.

- The business trust structure is ideal for the infrastructure industry, where projects are capital intensive, and generally offer stable cash flow once in operation.

- Industry sponsors could leverage on existing assets to fund growth.

- Through participation from unit investors who prefer the stable cash yield, and can enjoy the tax framework, the sponsor can access capital at attractive cost, redeploy it to finance growth, while maintaining management control of the assets.

- The Singapore business trust market presents an attractive option to raise capital, complementing the traditional sources of financing in responding to Asia’s demand for infrastructure.

- Next, I would like to touch on another area that is critical to the power business – Regulation.

- Regulation

- The power industry in Asia remains largely regulated. The role of regulation to the industry cannot be over-emphasized. Regulation set out the rules of the game. Changes in regulation realign risks & rewards.

- The regulator is expected to procure the long term sustainability of supply and the industry, and to strike the delicate balance among the stakeholders: consumers, producers, the industry and the economy.

- From the perspective of an investor, one of the most important investment criteria would be confidence in the regulator and the regulatory regime. It is important to know that the regulator is tuned to changes in market conditions, and is prepared to respond constructively where necessary.

- The upheavals of the past 2 years have highlighted significant shifts in market conditions. Volatility in markets has increased, and business cycles appear to have shortened. This poses increased risks to operators, and in turn, to the long term sustainability of service standards.

- Let me illustrate with a simple example.

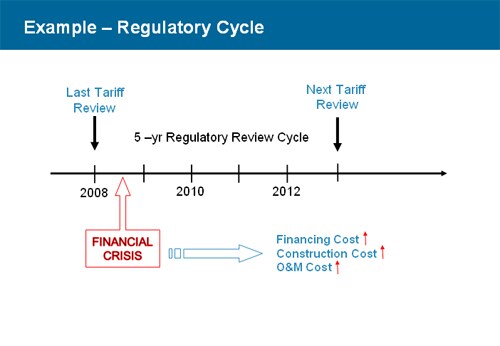

- The slide [Slide 3] shows a timeline of events experienced by a regulated distribution business operator.

- It has a cost-plus revenue model, with a typical 5-year regulatory review cycle.

- At the review in 2008, the regulated cost of capital and tariff were set based on favourable market conditions, with attractive terms for the supply of capital goods, and also for financing.

- Following the crisis in 2008, the operator is exposed to higher costs, and liquidity issues. The operator can be expected to take measures to stay afloat. These include cutting costs, stretching maintenance cycles and possibly disposing assets.

- More importantly, the operator will find it unattractive to invest, as the new investment will receive a regulated return that does not adequately cover the risk premium required by the prevailing market. Investments would be deferred, potentially impacting the longer term system sustainability and service quality.

- This outcome is not in the interest of the stakeholders. Should the regulator do something?

- It is the responsibility of the operator to manage its business and balance sheet so that it is able to bridge across business cycles. Surely, the regulator should not be expected to help.

- However the crisis of 2008 was unprecedented, and to set aside resources in anticipation of such an event would imply building in excessive buffer. It is not unreasonable for operators to be stressed by the crisis. Moreover, it is untenable to expect commercial operators to invest at a loss, or at returns below their cost of capital.

- So what can be done?

- I have come across a number of suggestions. For example, to mitigate future liquidity issues that could be brought about by short term market dislocations, the regulated tariff structure can provide for a sinking fund to pay for future capital expenditure.

- The most direct way would be to have a mid-cycle special adjustment to the regulated tariff, to reflect increased costs and risk premium. Alternate solutions could be to provide access to sources of capital with lower costs, such as grants, or subsidized loans.

- The above are merely suggestions. I recognize each come with associated costs and side effects.

- For instance, in the case of a mid-cycle tariff adjustment, to what extent should there be a corresponding adjustment downwards to tariff if market conditions become favourable?

- The costs and benefits must be weighed in totality, in accordance with each situation. The regulator is in the position to decide if they need to respond, and how they should go about it.

- As investors, the post crisis period offers the opportunity to observe the response of regulators to these events. The markets where regulators demonstrate high awareness and proactive response would score high. That would serve to point where we could invest.

Conclusion

- At this point, I would like to acknowledge the contribution of the Energy Market Authority. As the crisis hit in 2008, EMA responded and took the lead in the development of the LNG terminal. It is their responsiveness that kept the LNG terminal project on track; it broke ground last week.

- Since the decision 15 years ago to deregulate the Singapore power industry, the government and the EMA have steadfastly stood by their commitment to deregulation. It is evident, through Temasek’s divestment of the 3 power generation companies, that the international power industry has high confidence in the Singapore regulatory framework.

- The outcome of the divestment also signals that the businesses are regarded of high quality. That must be attributed to the staff, management, the board of directors, as well as the strong support from the union. I take this opportunity to thank them.

- We are pleased to welcome strong international players to the generation market, including Huaneng, Marubeni, GdF, Kansai Electric, Kyushu Electric, JBIC and YTL. They bring best practices, vast experience and business acumen to the Singapore industry. We are hopeful that they will all do very well in the long run, and be happy with their investments in Singapore.

- Finally, I would like to thank the organisers for this opportunity to share my perspectives. I wish you all a fruitful conference, and success investing in Asia power. Happy hunting, and

Thank you.