Temasek portfolio and performance remain robust

中文版 | Bản tiếng Việt | India Release | Bahasa Indonesia | Versão em Português | Versión en Español

July 09 portfolio at S$172 billion - up S$42 billion from March 09

35 year old investment company well-positioned for the future

- Temasek commemorated its 35 th anniversary on 25 June this year

- 5 years since it first published the annual Temasek Review

- Net portfolio value:

- 31 Mar 04 : S$ 90 billion

- 31 Mar 08 : S$ 185 billion

- 31 Mar 09 : S$ 130 billion

- 31 Jul 09 : S$ 172 billion

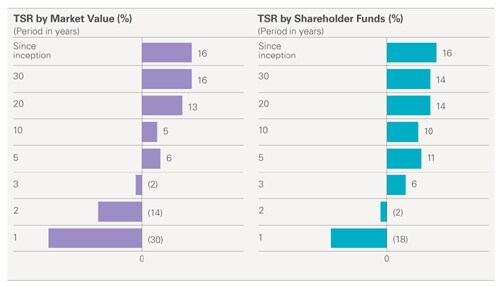

- Compounded annual Total Shareholder Return (TSR) as at 31 Mar 09:

- Since inception : +16% (by market value, and by shareholder funds)

- For one year : -30% (by market value)

-18% (by shareholder funds)

- For five years : +6% (by market value)

+11% (by shareholder funds)

- Group net profit for the year ended 31 Mar 09: S$6 billion

- Activities during the year :

- S$16 billion of divestments

- S$9 billion of investments, including S$3 billion of subscription to rights issues

- Long-term compensation framework tested through market downturn

- Since 2004, bulk of senior management bonuses deferred three to 12 years

- Clawback of deferred compensation due to negative Wealth Added (WA)

In its 35 th anniversary year, Temasek Holdings (Private) Limited ("Temasek") today released its Temasek Review 2009 for the latest financial year ended 31 March 2009. Published every year since 2004, the Temasek Review provides the company's group financial summary, as well as portfolio and investment highlights .

As an exempt private company under the Singapore Companies Act, Temasek is not required to publish its financials. Temasek provides audited financial report to its shareholder annually.

Performance

As at 31 March 2009, Temasek's portfolio value stood at S$130 billion by market value, up from S$90 billion five years ago . Five-year TSR was 6% by market value, and 11% by shareholder funds, impacted by the one-year TSR of negative 30% by market value, and negative 18% by shareholder funds. Temasek's long-term TSR since inception remained a healthy 16% by market value and by shareholder funds.

Temasek delivered a consolidated Group net profit of S$6 billion - about one third the record S$18 billion for the preceding financial year. The drop in Group profit reflected the lower contributions from both its portfolio companies and Temasek's investment activities.

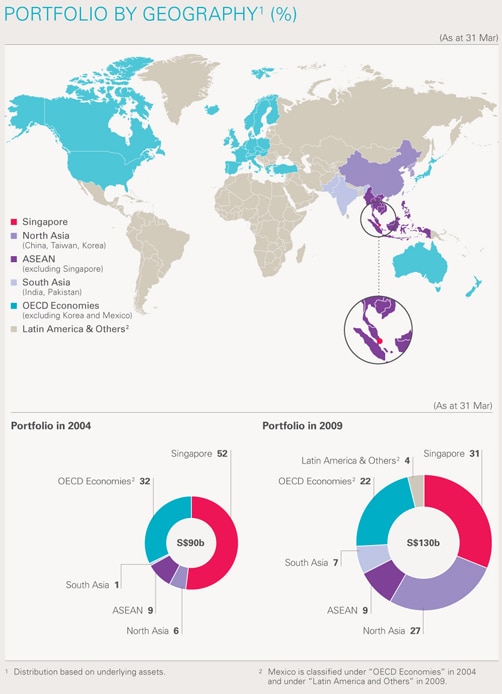

Temasek has a healthy book value of S$118 billion, up 80% from March 2004. The underlying exposure of its portfolio was 31% in Singapore, 43% in the rest of Asia (27% in North Asia, 9% in ASEAN, 7% in South Asia), 22% in OECD economies, and 4% in new markets such as Latin America, Russia and other regions.

Mr Dhanabalan, Chairman of Temasek Holdings said, "The markets have steadied since March this year. Our portfolio value and TSR have recovered broadly in line with the markets. Taken over the longer periods, our portfolio performance has been creditable."

He continued, "So, d espite a year of extreme volatility, we are confident that we have a robust portfolio for the long term."

Portfolio activities during the year

Temasek continued to reshape its portfolio steadily amidst a turbulent market.

In the year under review, Temasek made investments of S$9 billion and divestments of S$16 billion. Investments included S$3 billion into existing portfolio companies such as Standard Chartered, DBS Group Holdings and CapitaLand. In addition, Temasek invested selectively in companies such as Hong Kong 's Li & Fung, a leader in supply chain management for brands and retailers. In June this year, Temasek re-invested in Olam International, a Singapore-based leader in supply chain management for agricultural products and food ingredients.

Temasek divested its stakes in several companies including its two power generation companies in Singapore (Senoko Power and PowerSeraya), PT Bank Internasional Indonesia, Bank of America, China Minsheng Bank and SNP Corporation.

Ms Ho Ching, Chief Executive Officer and Executive Director, said, "We have been building up our liquidity methodically over the last two years with a net cash position as we were mindful of a possible downturn. However, we did not anticipate the speed and ferocity of the worst global financial crisis since the Great Depression.

"We are happy to have had the opportunity to participate in the rights issues of our portfolio companies. In general, our portfolio companies are well-positioned to ride out the crisis, especially in terms of their liquidity and financing needs. At the same time, we continue to invest steadily and selectively."

As at 31 July 2009, Temasek's portfolio value rose S$42 billion to S$172 billion, or 93% of its 31 March 2008 year end peak of S $185 billion. This reflected the market recovery along with Temasek's active and continuing reshaping of its portfolio.

Building for the future

Temasek remains committed to deliver sustainable long-term returns, and is well-positioned for the future.

Temasek continued to invest in its people, enhance its systems and processes, and strengthen its community care in Singapore and around Asia .

Since 2004, Temasek has put in place a well-balanced compensation framework which fosters a one-team culture, emphasises long term over short term, and aligns employee and shareholder interests. Within this framework, Temasek senior management have the bulk of their bonuses deferred between three to 12 years and subject to Temasek's sustained performance.

Mr Dhanabalan said, "We aim to foster a long-term owner's frame of mind in our team through a well-balanced compensation structure. While the downturn has been uncomfortable, it gave us the opportunity to test and refine the principles of allocating negative bonuses under our incentive framework, and also to finalise the remaining long-term components of our incentive framework to further align our staff to sustainable long-term performance."

The negative Wealth Added of S$6 billion for the previous financial year ended 31 March 2008 resulted in the clawback of long-term deferred bonuses in staff compensation last year. The negative Wealth Added of S$68 billion for the most recent financial year ended 31 March 2009 will translate to additional clawbacks of the remaining deferred staff bonuses this year. A negative Wealth Added means that the portfolio value did not reach the required hurdle, which is determined by a risk adjusted cost of capital charge and other adjustments.

Temasek expanded its international coverage to 12 offices and affiliates in Asia and Latin America, adding Chennai, Hanoi , Mexico City and São Paulo last year. Of its 380 multinational staff, some 20% are based outside Singapore .

As part of its 35 th anniversary commemorations, Temasek launched Temasek Cares in June 2009 with an endowment of S$100 million entrusted to Temasek Trust. Funding for this endowment came from provisions set aside for community contributions during previous years when Temasek achieved returns above its portfolio hurdles. Temasek Cares will focus on supporting the disadvantaged and needy in Singapore , and their caregivers, to be self-reliant or to provide them another chance to rebuild their lives. This new philanthropic organisation complements the support and contributions of other non-profit philanthropic organisations and beneficiaries of Temasek Trust such as Temasek Foundation and the Singapore Millennium Foundation.

Outlook

Temasek remains optimistic on Asia and other growth regions for the longer term.

Ms Ho Ching elaborated, " We believe that as Asia progresses, it will continue to de-risk. We are comfortable to overweight Asia . We are also adding exposures to other growth regions like Latin America . Our portfolio exposure today is almost equally balanced between the more developed economies and the newer growth regions.

She concluded, "We remain a long-term owner and investor focused on building a robust portfolio that can deliver sustainable returns for the long term. We have very capable and committed people in Temasek and our portfolio companies. They will be instrumental in taking Temasek and our portfolio companies forward."

- End -

1.Portfolio Value since Inception

.jpg)

2.Total Shareholder Return (% by Market Value and Shareholder Funds)

3.Portfolio by Geography (%)

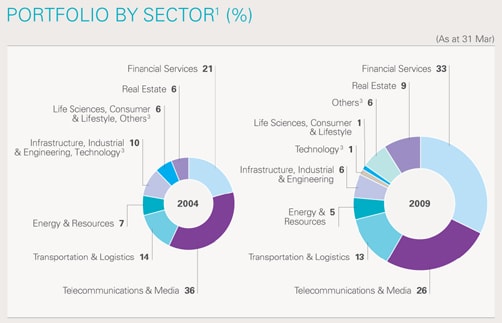

4.Portfolio by Sector (%)

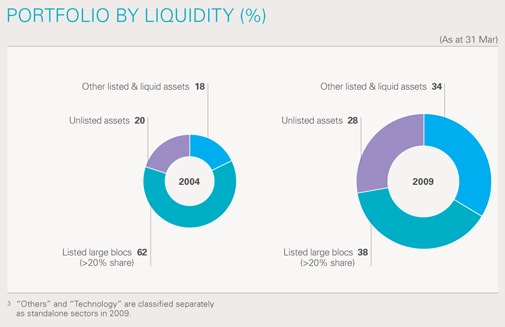

5.Portfolio by Liquidity (%)

Note to editors:

Temasek's financial highlights can be found in the Temasek Review 2009 issued today. The Temasek Review 2009 contains the Temasek group financial summary, investment and performance highlights for the year ended 31 March 2009. Its full contents can be retrieved from an interactive micro-site accessible at http://www.temasek.com.sg/temasekreview2009

About Temasek Holdings

Incorporated in 1974, Temasek Holdings is an Asia investment company headquartered in Singapore . Supported by 12 affiliates and offices in Asia and Latin America, Temasek owns a diversified S$172 billion (US$119 billion) portfolio as at 31 July 2009, concentrated principally in Singapore , Asia and the emerging economies.

Temasek's investment themes centre on Transforming Economies, Growing Middle Class, Deepening Comparative Advantages and Emerging Champions. Its portfolio covers a broad spectrum of industries: financial services; telecommunications & media; transportation & logistics; real estate; infrastructure, industrial & engineering; energy & resources; life sciences, consumer & lifestyle; and technology.

Total shareholder return for Temasek since its inception in 1974 has been a healthy 16% compounded annually. It has a corporate credit rating of AAA/Aaa by rating agencies Standard & Poor's and Moody's respectively.

For further information on Temasek, please visit http://www.temasek.com.sg/

Additional Information

- Opening Remarks (Checked against delivery)

- Temasek Review 2009 Media Conference Key Questions and Answers

- Photo of Ho Ching 01

- Photo of Ho Ching 02

- Photo of Panelists (L-R) Simon Israel, Ho Ching, Leong Wai Leng

- Biography for Panelists

- Temasek Review 2009 Technical Briefing Presentation

- Temasek Review 2009 Factsheet

For media queries, please contact:

Daliea Mohamad-Liauw

Director, Corporate Affairs

Tel: (65) 6828 6641

E-mail: daliea@temasek.com.sg

Lim Siow Joo

Associate Director, Corporate Affairs

Tel: (65) 6828 6503

E-mail: siowjoo@temasek.com.sg