How Temasek keeps its distance while working with boards

How Temasek keeps its distance while working with boards

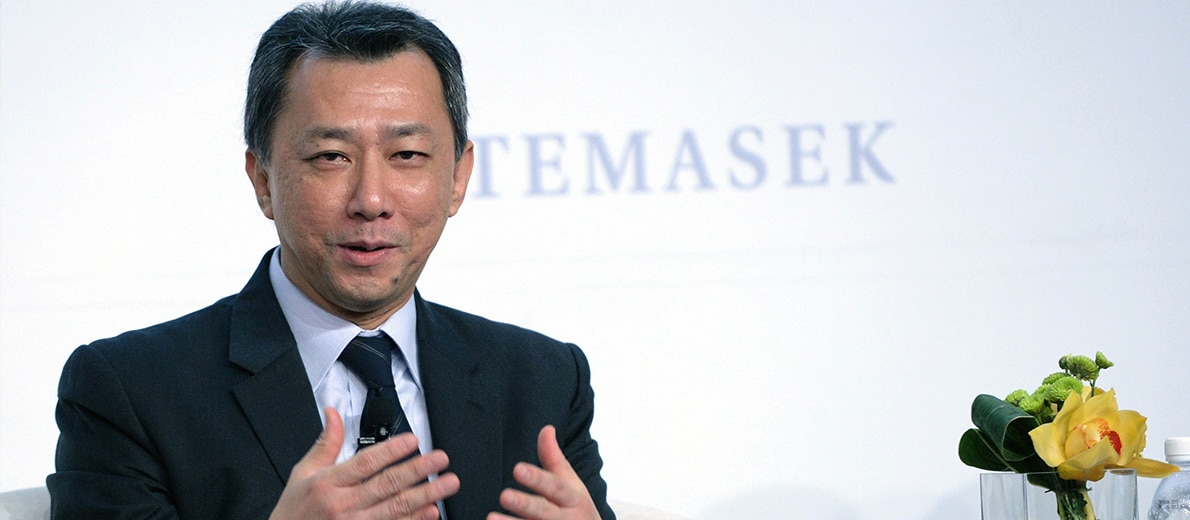

Board position is to help add to dialogue at board level: portfolio development head Nagi Hamiyeh

SINCE it began its approach of greater engagement with its portfolio companies, Temasek has seen a value uplift “north of S$10 billion”.

Some of the corporate actions that generated this uplift were:

- CapitaLand’s acquisition of real estate group Ascendas-Singbridge in 2019, and its subsequent restructuring into a listed real estate investment manager and a privately held real estate developer in 2021;

- A capital raising exercise for Singapore Airlines in 2020, to strengthen the airline’s balance sheet and prepare it for a reopening of borders following the pandemic;

- The Sembcorp Industries’ demerger from Sembcorp Marine in 2020, to focus on opportunities from the energy transition; and

- Keppel’s divestment of its offshore and marine operations in 2022, and its new focus on asset management.

Some of these moves have met with significant success. Sembcorp’s decision to shed its underperforming marine business, and to focus on the transition from brown to green energy, has created total returns of 69.6 per cent for shareholders (on an annualised basis since the announcement in June 2020).

“Success begets success,” said Nagi Hamiyeh, formerly head of Temasek’s portfolio development group and who now heads investment in Europe, Middle East and Africa, “When other Temasek portfolio companies see that one is successful, everybody becomes keener to undertake transformations like that.”

Other transformations are still a work-in-progress. CapitaLand Investment managed to garner a significantly higher valuation than its predecessor CapitaLand, but has since been hit by negative sentiment in the real estate market, particularly in China.

One transformation, in particular, has opened Temasek to criticism: the restructuring of Sembcorp Marine, now known as Seatrium.

The latter’s demerger from Sembcorp Industries and its acquisition of Keppel Offshore & Marine (KOM) put its shares in the hands of many shareholders who may not have wanted to own it in the first place. There was also unhappiness over the price tag of KOM.

Hamiyeh said the KOM acquisition had to happen for the group to survive. “It became very obvious that the only logic was to merge the two companies,” he said. He also believes the stock has done “fairly well” since the merger.

“Are we satisfied? No. But there are structural reasons to that,” he said, adding that he is confident that the company is turning itself around. “The leverage has gone down tremendously, which means the company is much more resilient. If we continue implementing this strategy, delivering projects at the margins that we aspire to by getting more projects, and then pivoting the business and adding new technologies to our offering, I think we would be very successful,” he said.

He also refuted any suggestion that Temasek’s decisions were not for the benefit of minority shareholders. In any investment Temasek makes, he said, the purpose is to get the best sustainable returns “which means any sensible investor would be thinking the same way”.

As a substantial – and sometimes controlling – shareholder in many portfolio companies, though, Temasek faces conflicts of interest. In particular, it is subject to what academics call the “Type 2 agency problem”, which is the conflict between majority and minority shareholders.

But Hamiyeh said this does not apply, because all decisions are made by the company’s board. “We are there as full partners. We help them when needed,” he said.

While Temasek does also get a board seat, Hamiyeh said there is a “clear delineation” between Temasek’s shareholder role and the board position.

“That’s why we don’t put many people on the board; the people we put there have to be people who can add value,” he added.

“All of us know the most important cardinal rule is we are there in our personal capacity to help add to the dialogue on the board level.

“Our obligations are to the company, not to Temasek. I cannot emphasise this enough because this is by far the most important principle.”

Success begets success. When other Temasek portfolio companies see that one is successful, everybody becomes keener to undertake transformations like that.

Nagi Hamiyeh, head of Temasek’s portfolio development group

This article was first published on 12 March, 2024 in The Business Times © SPH Media Limited. Permission required for reproduction