Giving everyday investors a new investment option

Giving everyday investors a new investment option

It was the fallout from the 2008 collapse of Lehman Brothers that prompted Temasek’s entry into the retail bond market, recalls Director of Investor Relations, Chong Hui Min.

When the global financial services company collapsed, investors in Singapore, many of whom were elderly and less educated, lost millions from investments in ‘Lehman Minibonds’, a risky structured product that had been marketed as a safe investment.

“Many people didn’t understand that ‘Lehman Minibonds’ were not actually bonds, but structured financial products. They thought they were buying safe ‘plain vanilla’ bonds, and ended up losing money,” says Hui Min. Temasek's then-CEO Ho Ching saw a need for safer investment options for individual investors. “That’s how the idea of a retail bond offering began.”

While Temasek had been issuing institutional bonds since 2005, it would not be until 2016 that the introduction of the Exemption for Offers of Straight Debentures would pave the way for the retail offering, and work on Temasek’s first retail bond would begin.

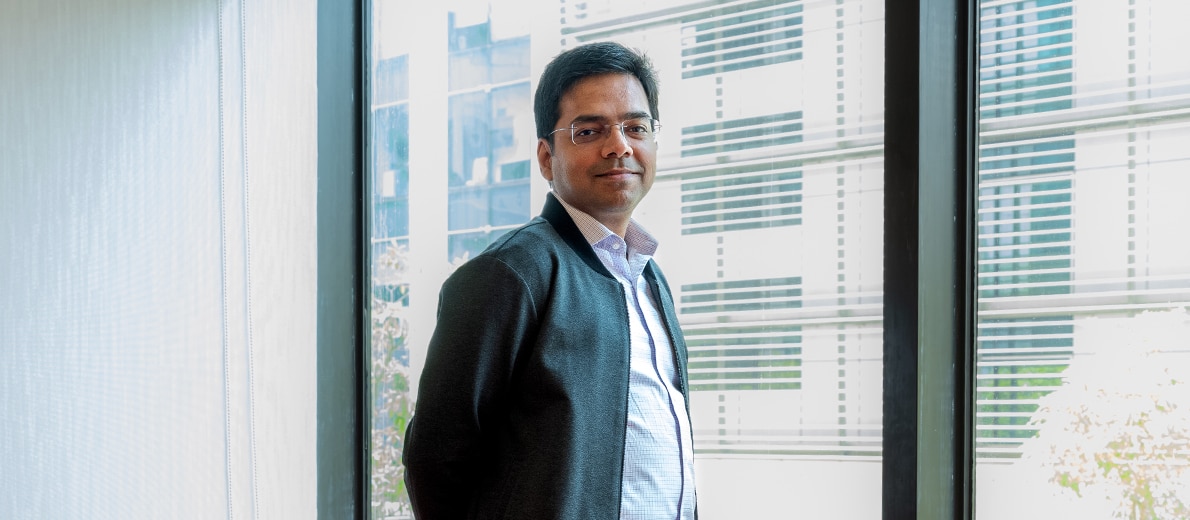

For Hui Min, who played a pivotal role in both the public consultations that led to the new regulations, and in the Temasek Bond issuance team, it has been a continuous learning journey. Until she joined Temasek in June 2009, the engineering and economics graduate had no experience in debt capital markets. “It was a steep learning curve at the start,” she laughs.

Empowering informed investing

“From the beginning, clarity was our mantra,” says Hui Min. “We wanted investors to understand exactly what was being offered.”

At a formidable 300-plus pages, the Offering Circular was a daunting read. To supplement this, the team created a concise 10-page “Offering Overview” that summarised the key points of the offering in clear, simple language, ensuring it would be easy even for a layman to understand. While investors still had to read the full circular, the team wanted to ensure they felt empowered, not intimidated.

Another priority was to reach as broad an audience as possible.

Advertising materials, translated into all four national languages, were distributed across platforms, including newspapers, radio, and a range of digital channels. “We had informational and engaging social media posts, explainer videos to simplify complex topics, and infographics with visual summaries. We also had a GIF that could be shared on WhatsApp,” says Hui Min. She remembers the radio ad becoming a familiar soundtrack on her drives home from work during the week of the offer. “Hearing it out there...it was very rewarding.”

Seminars to engage retail investors on the bond issuance were held at Suntec City and the Singapore Exchange Auditorium, catering to various schedules with after-office, lunchtime, and even Saturday morning sessions. Attendees could hear directly from Temasek’s senior management, ask questions, and pick up printed materials, which were also available at the branches of three major banks.

“We were running something like a logistics distribution centre – we worked with the banks on how many sets of the offering materials they needed delivered, and which branches would get the materials first since there were limited delivery vehicles.”

Among other things, the advertisements and brochures explained the critical step of setting up a Central Depository Account (CDP), which would ‘hold’ the bond. The team worked with the Singapore Exchange which went out of its way to ensure that everyone who went to its service centre walked out with a CDP account.

Communication remained open throughout the application period, where both the Temasek Investor Relations team and call centres at the three local banks fielded questions from the public. “We aimed to be thorough,” Hui Min says. "We weren't sure how many people might be new investors, so our approach was to over-communicate and make it as easy as possible to apply.”

The application window finally opened on October 17, 2018. “It was very satisfying to see the culmination of all the work we had been doing.”

A fulfilling journey

In the end, the $500 million bond received 50,000 applications and was over eight times oversubscribed, a testament to the strong market demand for quality retail bonds.

Looking back, Hui Min feels immense pride. “It was a long journey and a lot of hard work, but seeing the bond issue through was incredibly fulfilling. So many people contributed, and I am really grateful to have worked alongside such amazing colleagues and partners on this milestone.”

Beyond raising capital, the bond provided retail investors with a safer investment option, fulfilling the intention set nearly a decade ago. “I know of friends and relatives who benefited from their investment in our bond,” says Hui Min. “In a way, it contributed to their personal investment journey and helped them lay the foundation for a more secure future, often not just for themselves, but for their families. It ties directly back to Temasek's purpose: So Every Generation Prospers.”

From the beginning, clarity was our mantra. We wanted investors to understand exactly what was being offered.

Chong Hui Min

As we mark our 50th anniversary, we present 50 stories from our staff, alumni, and beneficiaries who have been a part of Temasek's journey through the years.

Hear for the first time their anecdotes of what went on behind the scenes as they grew alongside the firm. Together, they capture pivotal milestones of Temasek, and tell the story of an institution built By Generations, For Generations.