Transcript: Temasek Review 2021 Media Conference

The following is a transcript of the Presentation of the 2021 Temasek Review. The text should be read in conjunction with the slides shown in this transcript. It has been edited from delivery only for readability.

To refer to a selected transcript of the Question & Answer session which followed, click here.

To see all of the key financial metrics and diagrams in the 2021 Temasek Review, please click here.

STEPHEN FORSHAW:

Good afternoon, everyone. My name is Stephen Forshaw. Welcome to Temasek Review 2021.

Our theme for this year, as we Bounce Forward to a world beyond COVID, to a world with opportunities created by digitisation and the challenge of climate change. Our team will share with you today our performance for the financial year ended 31 March 2021.

Just let me cover a few housekeeping matters for the benefit of those who are watching us this afternoon. When we report today, all of our figures will be in Singapore dollars unless indicated otherwise. During the report we will also share information about our portfolio exposure by geography. I just want to take a moment to share with you that we share our portfolio by geography based on the underlying exposure of the assets in the portfolio. A simple way to think about that is that as our portfolio companies investment beyond their home country, we count the exposure of the assets in the country in which they sit, to give you a broad representation of where our portfolio operations will sit.

For today's media conference, could I ask members of the media to keep your cameras on, and especially when we get to Q&A to only unmute yourself when we get to the Q&A, and I will call on you at that time. If you have any technical issues during the course of the presentation, you can direct them to our WhatsApp group and likewise, if we have any technical issues on our side we'll reach out to you through that WhatsApp group.

I'd like to take a moment to introduce my colleagues who will join the presentation this afternoon. In a moment, I will introduce Fock Wai Hoong, Managing Director, Telecommunications, Media and Technology and South East Asia, who will lead the presentation. We'll also share a couple of videos during the presentation. After the presentation, for the Q&A, Wai Hoong will be joined by Nagi Hamiyeh, the Joint Head of our Investment Group and the Head of our Portfolio Development Group. He will also be joined by Neo Gim Huay, the Managing Director of Climate Change Strategy, and also Mukul Chawla. Mukul is the Joint Head of North America and Joint Head of the Telecommunications, Media and Technology Group.

We will also share some of the videos for our year end review during Wai Hoong's presentation before we get to the Q&A. When we do come to the Q&A, if I can ask you to use the raised hand function on Zoom. If you click on the "Participants" button and just wait for your turn, I will call on you. I want to make sure we get to as many questions as we can and we give a turn to as many people as we can.

When I do call on you, could you wait a moment while we can spotlight you for the benefit of the panellists in the room here, who will then be able to see you and hear you through our sound system. As I say, do make sure that you're unmuted and also that we can see you onscreen. After you've finished your question, if you can then go back on mute so we don't get background noise or echo.

Today's presentation is under embargo until 3.00 pm, so please do observe that embargo. A recording will be made available online after the session.

So look, they're the housekeeping matters. It's now my very great pleasure to introduce to you Temasek Review 2021 with our video year in review.

FOCK WAI HOONG:

Good afternoon everyone.

My name is Wai Hoong.

As we bounce forward from COVID-19,

a brighter future lies ahead.

Today,

I would like to share with you what we’re doing

to move into this new world.

Going forward,

we are guided by our roles as defined in our charter:

as an investor, an institution and a steward.

We see ourselves as a provider of Catalytic Capital

in these 4 areas:

Financial, Natural, Human and Social.

Financial Capital stimulates innovation and growth.

Natural Capital fosters sustainable solutions

for a more liveable world.

Human Capital uplifts people’s capabilities.

And Social Capital enables resilience

and a more inclusive world.

As an active investor and engaged owner,

we continue to reshape our portfolio.

Let me take you through our performance and

explain how we deploy financial capital

to deliver sustainable value over the long term.

This slide shows our Net Portfolio Value, or NPV,

over the past decade.

We ended our last financial year

with an NPV of 381 billion dollars.

Over the past decade,

our NPV has doubled.

This chart shows our investment activity.

Last year was a very active year for us.

We invested 49 billion dollars and divested 39 billion –

both record numbers in a single year.

Over the decade, we have invested 276 billion

and divested 212 billion.

This represents a net investment of 64 billion

over the past decade.

This pie chart is a snapshot of our portfolio by sector.

Financial Services and TMT remain as our largest sectors.

However, the composition within those sectors has evolved over the decade.

Previously, Financial Services comprised almost entirely of Banks.

Now, we’ve shifted our focus to include more exposure

to Insurance, Fintech and Payments.

And they make up almost half of our Financial Services portfolio today.

In the TMT domain,

we’ve expanded our focus beyond Telecommunications.

Technology and Media is now over half of our TMT exposure.

Life Sciences and Agri-Food investment

are in line with our focus on structural trends.

You can also see how we have grown this sector

from 1% a decade ago to 10% today.

On this slide, you will see how we’ve grown our focus areas, in purple.

In 2011, they comprised just 5% of our portfolio.

This included Consumer, Media & Technology,

Life Sciences & Agri-Food and Non-Bank Financial Services.

Today,

these focus areas make up 37% of our overall portfolio.

This is significantly larger than a decade ago.

Our exposure has grown

from less than 10 billion

to over 140 billion.

This is almost 16 times higher in absolute dollar terms.

Now let's look at our portfolio from a geographic perspective.

Our exposure by region has also evolved meaningfully

over the last decade.

Today, our exposure to the developed economies

has increased to about 60%.

This is mainly due to the growth in investments

in Europe and the Americas.

You may see that Singapore’s percentage share of our portfolio

has declined from a decade ago.

But, it has increased by 50% in absolute dollar terms,

from about 60 billion to 90 billion.

Also, our Singapore companies have expanded beyond home shores.

For example, CapitaLand has grown in China over the decade

and its growth there is reflected in our China portfolio.

Overall, we remain firmly anchored in Asia,

with Singapore and China continuing to be

our two largest geographic exposures.

This pie chart shows the liquidity mix of our portfolio.

As you can see, the very liquid part of our portfolio, in green

has remained near constant,

at 38%, similar to a decade ago.

This provides us more than adequate cover for our bond obligations.

On the other hand,

our holdings in unlisted assets have grown from a decade ago.

Over longer time horizons,

these unlisted investments have delivered strong returns to Temasek.

Investments in this space such as Mapletree, SP Group and PSA

have continued to pay steady dividends over the years.

Now, this chart shows our one-year total shareholder return, or TSR,

since 2003.

As you saw earlier in the video, our one-year TSR – in blue –

is 24.53%.

The purple line, shows our 10-year TSR at 7%,

while the orange line, shows our 20-year TSR at 8%.

This chart shows our one-year, 10-year and 20-year TSRs,

and those over longer time periods.

For reference, we show various market indices such as

the MSCI Singapore Index, in pink,

the MSCI Asia excluding Japan, in light blue,

and the MSCI World, in orange.

You’ll see that we generally outperformed those indices

over longer timeframes.

While I share this data with you as a reference point,

we don’t manage our portfolio by public market benchmarks.

This is because our portfolio composition is very different

from the make-up of the various indices.

Our geographic exposure is on the left.

You can see it is different from the MSCI World chart on the right.

For example, Singapore and China, represented in pink and dark blue,

make up more than half of our portfolio.

However, they only constitute less than 2% on the MSCI World index.

Together, Asia constitutes 64% of our portfolio

whereas it is less than 10% on the MSCI World index.

In addition, our portfolio includes investments in the unlisted space.

This again differentiates us from the market indices.

Last year, we refreshed our views to better capture new opportunities –

we expect these trends to shape our long term portfolio construction.

The first trend, Digitisation, has accelerated due to COVID-19.

We’ve invested in companies that benefit from this trend

such as Flywire, FNZ, and Black Lake.

Next, Sustainable Living supports the transition

to a low carbon and more sustainable economy.

Here, we’ve partnered innovative companies such as

Eavor Technologies, O2 Power and Rivulis.

Thirdly, the Future of Consumption anticipates how

consumers will shop and play in an omnichannel world.

Southeast Asian consumer internet companies such as

SEA Limited and GoTo Group are part of our portfolio.

In China, we continue to invest in innovative brands

such as Genki Forest.

Lastly, the Longer Lifespans trend guides our focus on life cycle needs

of people and societies as we live longer, fuller lives.

Some of our investments in this space include

BioNTech, Clover Biopharmaceuticals and Vir Biotechnology.

Let’s shift gears a little and talk about the global outlook.

We expect the global economy to recover steadily.

Major economies are starting to ease lockdown measures,

and have embarked on mass vaccination programmes.

Policymakers are keeping monetary and fiscal policies accommodative.

However, the pace of recovery will likely be uneven across countries.

Some countries are struggling with new waves of infections.

Others are experiencing delayed vaccine rollouts

and production capacity constraints.

In addition, uncertainty remains around the virulence of new COVID-19 variants.

And there is added geopolitical uncertainty

as tensions continue between China and the US.

All that said, climate change remains as one of the most crucial global challenges.

Governments, businesses and communities all need to take action to combat global warming.

This slide shows our projected returns at the end of a 20-year period.

The vertical axis shows the relative likelihood,

while the horizontal axis shows the geometric returns.

We start with a Central Scenario – a base case –

this is shown here in purple.

Other scenarios include China Hard Landing, Severe Escalation in Trade and Tech Tensions, Secular Stagnation Scenarios, as well as differing Climate Change Pathways.

Broadly, the Central Scenario offers us higher expected returns,

compared to most of the other alternate scenarios.

However, let’s take a closer look at the various Climate Change Pathways.

These 4 charts show the returns pathway over the next 20 years

across the key market regions of the US, Eurozone, China and Singapore.

Together, these markets form about three quarters

of our underlying portfolio exposure.

The purple line shows our central scenario

which offers a baseline expectation of growth for our portfolio.

The orange lines show the LOW ambition climate change scenarios

while the green lines show the HIGH ambition climate change scenarios.

As these 4 charts are directionally similar,

let’s zoom in on China as an example.

Take a look at the outer years of the projected market index value for China.

You can see that a High Ambition Climate Change pathway, in green,

provides us with better expected returns in the long run.

In the medium term, however, we may see returns moderate slightly.

This is due to the costs associated with transition.

A Low Ambition Climate Change pathway, on the other hand,

delivers lower expected returns in the longer term.

So a high ambition climate change pathway delivers

a better planet, healthier people and more sustainable prosperity.

With this in mind,

Sustainability is very much at the core of all that we do.

We look at how we can enable natural capital

to foster sustainable solutions for the climate

and a more liveable world.

Two years ago, we achieved carbon neutral status as a company.

We have continued to maintain it this year.

To effectively deal with carbon emissions,

we internalise the cost of carbon in our investment decision making.

We now have an initial internal carbon price

of 42 US dollars per tonne of carbon dioxide equivalent.

We have also embedded a sustainability-linked component

in our long term incentives.

And for our portfolio, as you know,

we are committed to halving our 2010 carbon emission levels, by 2030.

This is a crucial step toward our ambition

for net zero carbon emissions by 2050.

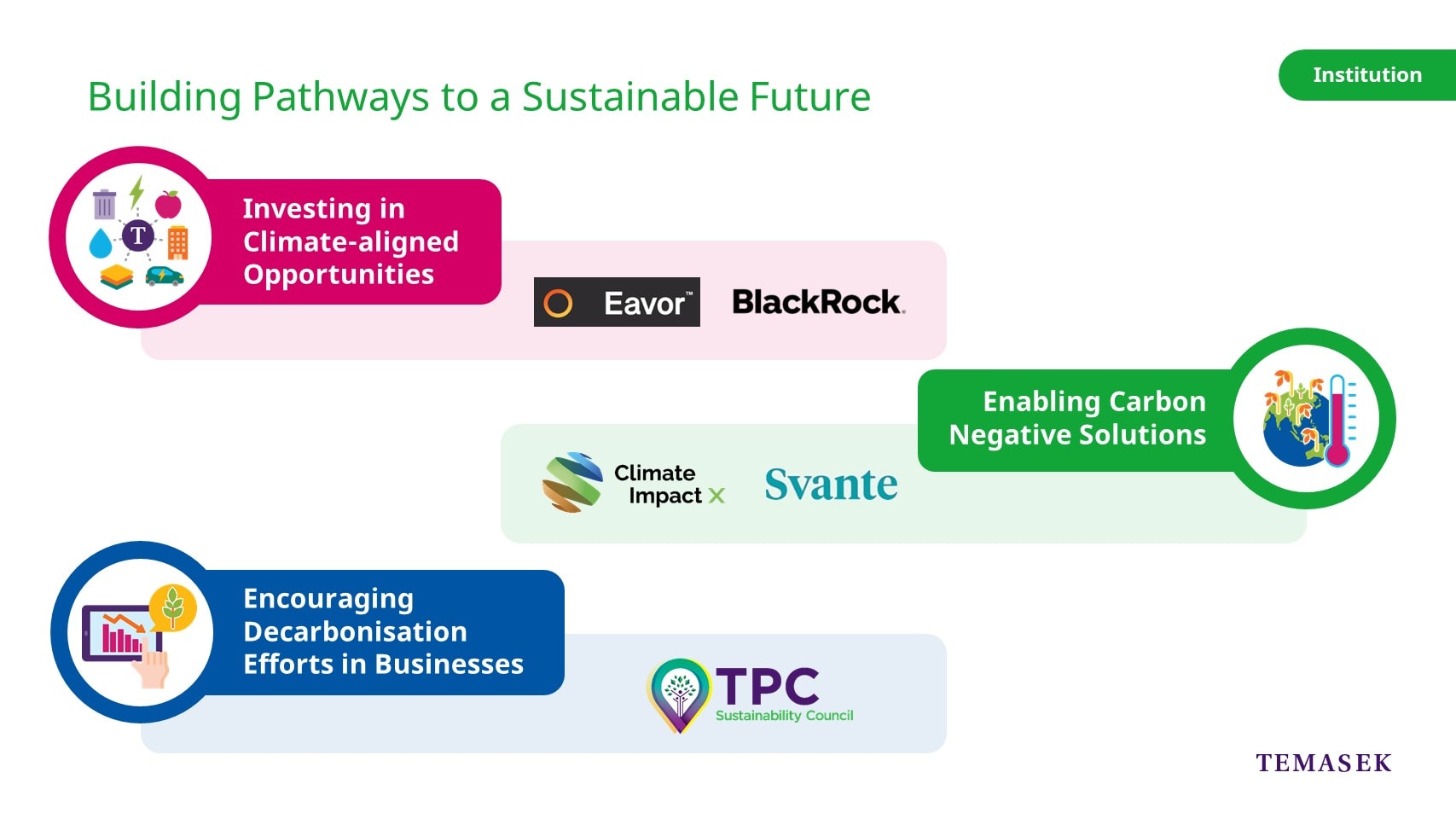

To accomplish this,

we are adopting a three-pronged approach towards our ambition.

First, we seek investments in climate-aligned opportunities.

Last year, we invested in Eavor Technologies.

This company develops geothermal energy solutions.

We also partnered BlackRock

to establish a fund called, Decarbonization Partners.

This is to invest in companies and technologies

that will reduce or eliminate carbon emissions.

Next, we look to enable carbon negative solutions,

such as Carbon Capture, Utilisation and Storage,

as and when these become feasible.

And we’ve taken a first step with our investment in Svante,

which specialises in low cost carbon capture technology.

Also, our joint venture, Climate Impact X or CIX,

offers a global marketplace for high quality carbon credits.

Finally, we will continue to encourage decarbonisation efforts in businesses.

Over the year, we’ve stepped up engagement with our portfolio companies.

We formed a Sustainability Council,

to share knowledge and tools for carbon measurement,

climate risk assessments and disclosures.

This helps all of us work towards shared sustainability outcomes.

Now, let’s watch a video to show how Temasek is accelerating

the momentum towards a net zero world.

To enable a more sustainable world,

it is important for us to invest in human capital

by developing our people and capabilities.

Our new Strategic Development function

is investing further upstream

in emerging science and technology innovation.

We have our Blockchain and AI pods

which are continuing to expand their capabilities.

For example, our Blockchain pod founded LemmaTree.

This seeks to develop verifiable digital identities

using distributed ledger systems.

We also have a new Centre of Excellence

to build deep expertise in AI.

It works with our portfolio companies to deliver better outcomes

in this rapidly emerging space.

Cybersecurity continues to be a critical focus,

both as a capability and as an investment space.

And this is why we’ve set up ISTARI, a global cybersecurity platform.

Across our firm, our people have been upskilling themselves

in areas like cybersecurity and data science.

As you can see, over the years,

we have expanded our global presence to key cities around the world.

During 2020, we set up two new offices in Brussels and Shenzhen.

Our Brussels office helps us build deeper institutional relations.

It also helps us gain insights into key policy areas within the European Union.

The China Greater Bay Area is a bustling innovation and technology hub.

That’s why we set up a new office in Shenzhen to tap on these growth opportunities.

Together, these new offices bring our total global footprint

to 13 locations around the world.

Our Stewardship commitment

is to build community resilience

in the face of adversity.

COVID-19 has not derailed this.

From our first video,

you would have seen how we emphasised

giving back to our community

and seeding social capital to do good.

We continue to safeguard our communities

through five areas:

Testing & Diagnosis,

Protection & Prevention,

Containment & Contact Tracing,

Care & Treatment,

and Enablement.

I’ll now share some initiatives we’ve worked on

in these five areas.

Starting with Testing and Diagnosis,

we partnered with diagnostic labs

to automate PCR test processing.

This has helped them process over a million PCR tests.

We piloted the Antigen Rapid Test for on-site pre-event screenings.

This is to allow events and social gatherings to resume safely.

Such initiatives will help us in detecting the virus in our community more quickly.

Containment and Contact Tracing have been key to our COVID-19 efforts.

Early last year,

we activated our portfolio companies to set up Community Care Facilities.

This is to house COVID-19 patients with mild or no symptoms.

These facilities help to reduce the pressure on our hospital system.

Next, Contact Tracing remains the central tenet of containment.

We encouraged our portfolio company, D’Crypt, to develop BluePass.

This is a Bluetooth-enabled contact tracing device.

We have distributed these to densely populated workplaces,

such as construction sites.

We also worked with investee companies

in our life sciences portfolio.

This is to ensure people are cared for and treated

during these tough times.

For example, in developing COVID-19 antibody treatments,

we have Vir Biotechnology in the US,

as well as Tychan in Singapore.

As you saw in our video earlier,

we have also distributed essential items

to help the community stay prepared.

Items include masks, face shields and hand sanitisers.

Over 30 million reusable masks were collected

through vending machines across the island.

We also helped to provide

one hundred thousand bottles of Vitamin D tablets

for vulnerable families, seniors and expectant mothers.

Enabling and supporting vulnerable communities is vital

throughout this challenging time.

Temasek Trust launched the oscar@sg fund

to encourage ground-up community projects.

It heartens us that this fund has seeded

over 200 meaningful projects,

and touched over 500,000 lives in Singapore.

One of the projects is VintageRadio.SG.

This a digital app that curates content like nostalgic tunes for seniors.

This has been especially important during periods of isolation.

As we know, no one is safe till everyone is safe.

Beyond Singapore, we have been doing our our part

to strengthen the resilience and preparedness of communities.

To support this,

Temasek Foundation stepped forward early

to provide medical supplies to some 40 countries,

in, and outside Asia.

These included

diagnostic test kits, testing machines,

oxygen and ventilation equipment, and masks.

I’m sure you know the World Food Programme,

recipient of the 2020 Nobel Peace Prize.

Despite their name, they don’t just move food!

During the pandemic, they’ve taken on the role of

supplying essential medical and protective equipment

to countries and regions in desperate need of UN assistance.

Temasek Foundation and Singapore Airlines

established a partnership with them

to transport medical supplies and humanitarian items

across Asia and the Pacific using SIA’s planes.

Today, I’m very pleased to announce

That this partnership has just been renewed.

This will help move critical supplies to more countries

such as Indonesia, Nepal, Bangladesh and India.

And we would like to thank partners such as Olam,

for making even more flights possible.

Looking ahead,

What does the

future hold for us?

We need to continue our efforts to

build a resilient, future-ready portfolio,

where sustainability remains at the core.

As we grow our portfolio in line with our focus areas,

our people continue to upskill and grow.

We will also deepen our bench

with new skillsets from outside.

All these efforts are underpinned by three important pillars:

Being a Purpose-driven Organisation

with a strong culture and clear values.

Providing catalytic capital to solve big, global challenges,

and building a Networked Organisation,

both within Temasek and across our ecosystem.

In doing so,

we seek to realise opportunities

for the prosperity of future generations.

Let me end with a video

showing how some of our staff

help others Bounce Forward.

It shows how we mentor young entrepreneurs to achieve greater social impact.

Thank you.