Transcript of Temasek Review 2015 Media Conference

The following is a transcript of the Presentation of the 2015 Temasek Review. The text should be read in conjunction with the slides shown in this transcript. To refer to an edited transcript of the Question & Answer session which followed, click here.

STEPHEN FORSHAW: Good afternoon, ladies and gentleman, a very warm welcome to Temasek Review 2015. Our theme this year: Embracing the Future. My name is Stephen Forshaw, thank you all for making the time to come and spend the afternoon with us We have a panel presentation for you shortly covering the results that are in our Temasek review. We'll then have a question and answer session with our panel after that.

So that you're aware, whenever any figures are discussed this afternoon our reporting currency is in Singapore dollars. So the figures, unless otherwise indicated, will be in Singapore dollars.

Our annual review covers the period 1 April 2014 to 31 March 2015. The document will also be available online after 3pm at temasekreview.com.sg and you can follow us on Twitter, @Temasek, if you want to catch the snippets as they come through.

Our panel this year consists of three presenters. We are starting with Png Chin Yee, Managing Director, Investments. We'll then be moving to Ravi Lambah, Senior Managing Director, Investments and concluding with Neil McGregor, Senior Managing Director of our Enterprise Development Group.

They will be joined for the Q&A afterwards by Leong Wai Leng, our Chief Financial Officer and Wu Yibing, who will be familiar to many of you from last year's presentation, who is our head of China.

So with no further ado please allow me to introduce Chin Yee to kick off the presentation this year.

PNG CHIN YEE: Thanks, Stephen. Good afternoon, my name is Chin Yee. I have to start first by congratulating Bloomberg! You put out an estimate of our performance and I have to say, you came pretty close to the mark! I guess it says something about transparency and our disclosure. So you would know that at the end of the year a strong growth in our portfolio benefitting from benign global market conditions. This positions us well to embrace the future, to take advantage of the opportunities that we see ahead. At the same time, we continue to build the institution and stepped up in our role as a builder of businesses. My colleagues and I will take you through our year in review and I will kick off with the review of our performance.

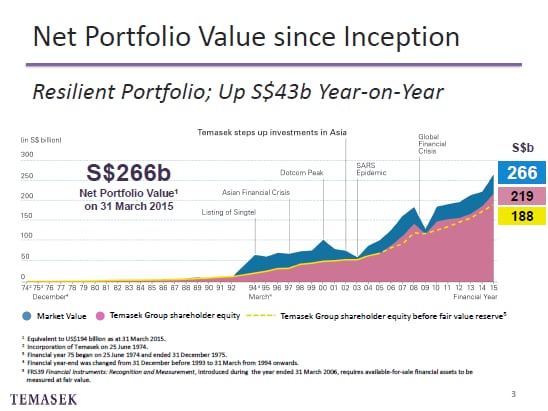

We ended the year with a portfolio value of $266 billion, up $43 billion from last year. This chart shows you our portfolio by market value. This can be volatile, year on year as it reflects market movements.

The pink portion shows our shareholders' equity. This shows steady growth through accumulation of profits and earnings from our investment activities.

The yellow line shows our group shareholder equity before fair value reserve. This line is much more stable. It reflects the growth and underlying earnings without mark to market volatility.

Our net portfolio value of $266 billion has more than doubled over the last decade.

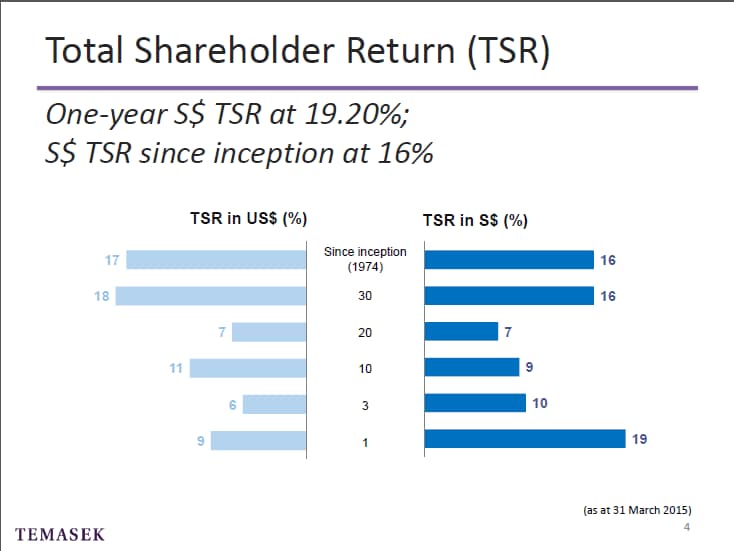

This chart shows our total shareholder return, or TSR, over different time periods. TSR measures the return that we deliver to our shareholder. It includes dividends to shareholder, but excludes capital injection from our shareholder. We regard this as a key measure of our performance.

Our 1‑year TSR was 19.2% driven by the strong performance of our Singapore and China portfolios. Longer term, 10‑year and 20‑year TSRs were 9 and 7% respectively. Our TSR since inception was 16%.

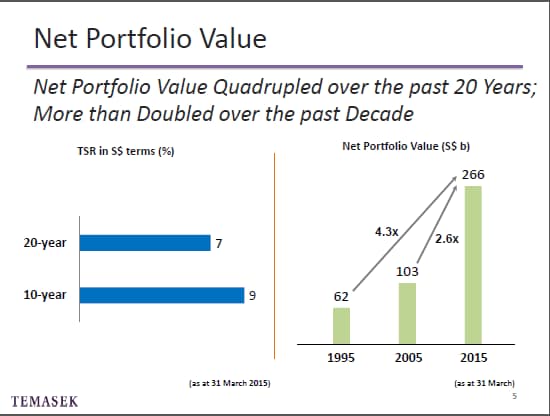

You can see on the left the 10 and 20‑year TSRs that we spoke about. The chart on the right shows that our portfolio has quadrupled over the last 20 years and more than doubled over the last decade.

We evaluate our performance by comparing our TSRs against our risk‑adjusted cost of capital. Our risk‑adjusted cost of capital has typically been in the range of 8 to 9%. It is calculated on a bottom‑up basis. It is a weighted average of the risk‑adjusted cost of capital of all our investments.

The blue bars show Temasek's returns and the green bar shows our risk‑adjusted cost of capital.

Over the last year our returns of 19.2% were above our risk‑weighted cost of capital of 8%. For most periods, you can see that our returns have met or exceeded our risk‑adjusted cost of capital.

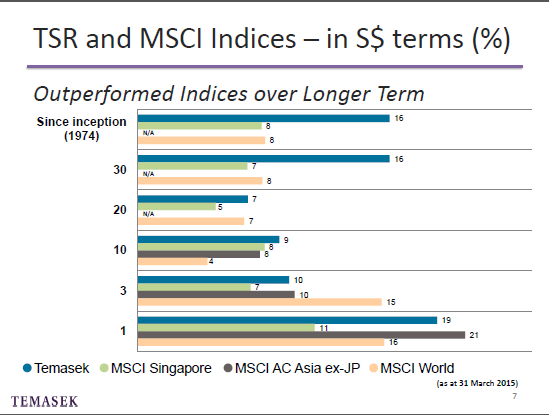

This chart shows our returns, the blue bar, placed alongside public market indices ‑ MSCI Asia, MSCI Singapore, MSCI Asia ex‑Japan and MSCI World. We are not a fund manager, we do not manage our performance according to benchmarks. In fact, our portfolio is very different. We have the ability to take long term concentrated positions. We also invest in non‑listed assets. But we're often asked for comparisons and this can be one frame of reference.

Over different time periods Temasek has generally outperformed the relevant indices.

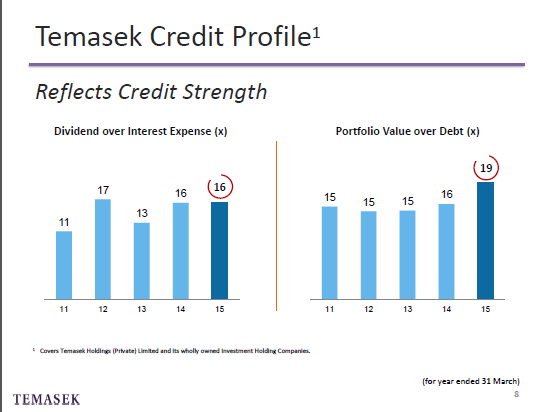

Our credit profile provides a snapshot of our credit quality and the strength of Temasek's financial position. Our dividend income is 16 times our interest expense. Our portfolio value is 19 times our debt outstanding.

Let me now move onto the Temasek Group financial performance.

The Temasek Group financials are a line‑by‑line consolidation of Temasek and our operating subsidiaries.

Our group revenues therefore include revenues of listed subsidiaries such as Singtel as well as unlisted subsidiaries such as PSA.

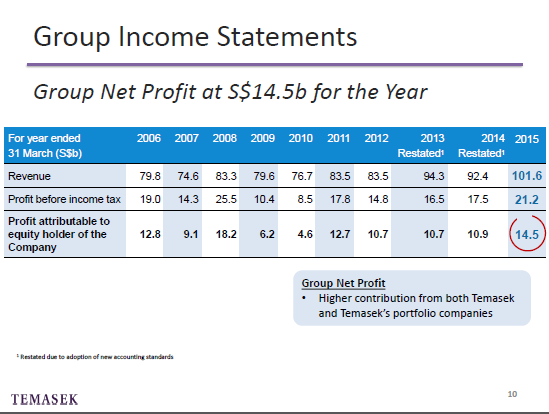

The Temasek Group Net Profit reflects the net profit from underlying companies as well as the returns from Temasek's investment activities realised during the year. Our net profit for the year was around $14.5 billion. This has increased due to higher contribution from both Temasek as well as our portfolio companies.

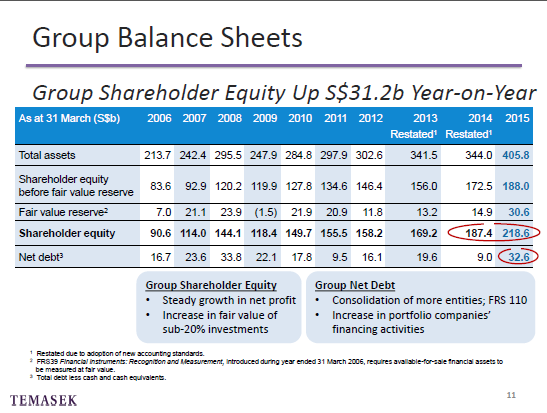

The group's balance sheet highlights the financial strength of the Temasek Group. Our group shareholders' equity was $219 billion, up $31 billion from last year.

We had consolidated net debt of $33 billion. The rise in net debt is largely due to the consolidation of more entities which included the impact from new accounting standards FRS110. This also reflected an increase in our portfolio companies' financing activities.

Having said that, Temasek itself ended the year in a net cash position. This adds to our financial flexibility to step up our investment pace to take advantage of the opportunities ahead. I will now hand over to Ravi who will talk about investment activities, our portfolio and our outlook. Ravi.

RAVI LAMBAH: Well good afternoon, everyone. I am Ravi Lambah and I will now continue to present the highlights of our investment activities this year as well as take you through some of the highlights of our portfolio.

This slide lists our four investment themes and some of you may have seen these before. We continue to be guided by our four investment themes which are highlighted on this slide. We target our investments to generate sustainable returns over the long term and these themes have helped to shape our portfolio. That reflects now a growing Asia and other mature markets that are recovering from the crisis.

Let me now talk a little bit about our investments and divestments in the year.

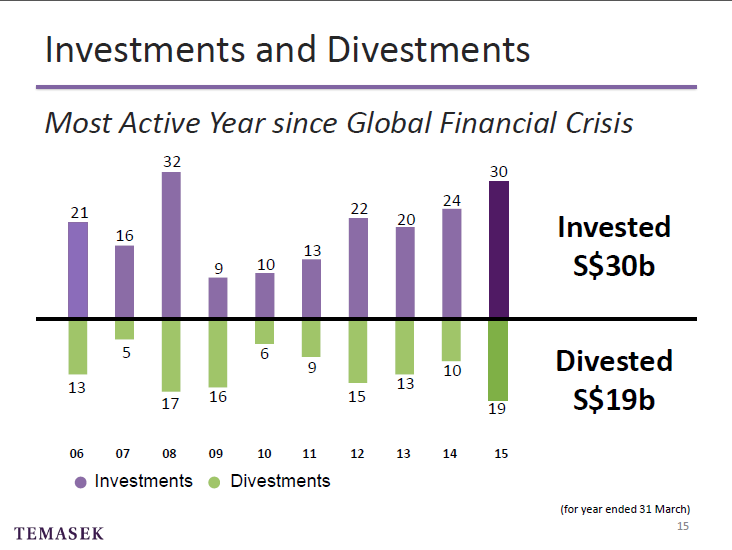

So this year was the most active for us since the global financial crisis. We made new investments of $30 billion in this past year and almost half of our new investments were in Asia and notably the rest were mainly in North America and Europe. Our pace of new investments reflects our constructive view of the global economy over the next several years.

Now let me talk about divestments in the year. We sold $19 billion of divestments in this year and we stepped up our divestments in the latter half of the year to capitalise on the liquidity driven rally in some markets.

On the next slide I will go into a little bit more detail about our investment and divestment activities.

The largest share of our new investments were in Asia, as I said, and if you look at the slide it will be quite evident to you that the top three sectors of our investment were consumer, financial services, and life sciences.

I will give you a few details about some of these investments.

In the consumer sector we invested in AS Watson. AS Watson is a leading international health and beauty retailer, with over 11,000 stores in Asia and Europe. It's hard to travel around Asia and not see a Watson’s store.

We also acquired a majority stake in Olam which is a global agribusiness. In financial services, we invested in electronic market maker, Virtu Financial, and we also invested in a global payments company Adyen. We expanded our financial services exposure into some nonbanking subsectors like insurance. In doing so we invested in Prudential PLC and in the NN Group.

Let me now talk a little bit about the life sciences sector. First, we increased our stake in Gilead Sciences. Gilead is a US‑based biopharmaceutical company at the cutting edge of developing novel therapies for cures for cancer and infectious diseases. Second, we invested in Ceva which is a leading global animal health company.

I shall now look at some of our divestments in the year. We sold approximately 1% of our stake in China Construction Bank during the year, however I would like to note that we still hold all our pre‑IPO shares that we held prior to 2005.

As you may be aware Alibaba went public this year. We took the opportunity to sell about 10% of our long‑held stake in Alibaba.

Now in terms of where we fully divested our holdings, these include Mosaic, Medreich and Kunlun Energy.

That wraps up our investment and divestment activities and now I will describe to you a little bit more about our portfolio from a different context.

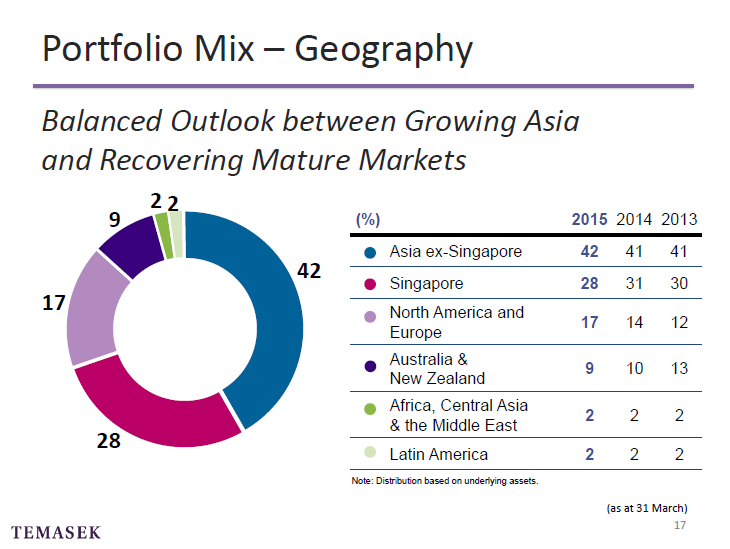

Let's look at the portfolio mix by geography. Now the portfolio mix by geography is based on a distribution which itself is based on our underlying assets.

Maybe I will explain that to you by way of an example so it's clear how we look at it. Let's take Singapore Telecom, as an example, a portfolio company in our group. Singtel is listed in Singapore but it has assets in other countries like Australia, Indonesia, India and others. What we do when we come up with our portfolio mix by geography is we allocate the value of our holdings in Singtel according to Singtel's assets in these countries.

So based on that, in 2015 Asia, including Singapore, represented 70% of our total portfolio. Our exposure in North America and Europe now aggregates to 17% of our total portfolio. North America, out of the 17, is 9% and Europe is 8%.

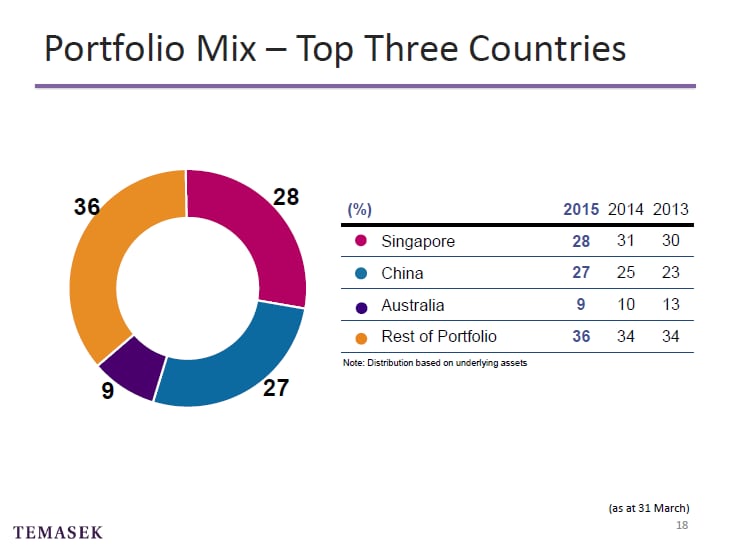

Let me now look at our portfolio mix by the top three countries of our exposure. Singapore remains our largest country of exposure. Our exposure here has increased in absolute dollar terms from last year, even though, as you will see, the percentage has dropped from 31% last year to 28%.

China - our exposure is now at 27%. This has steadily grown over the years. We started investing in banks and we have since broadened our investments into other sectors that include technology, insurance and consumer.

Australia largely reflects our indirect exposure from our portfolio companies, primarily Singtel and Singapore Power.

That's our portfolio mix in the top three countries.

Let me now give you a view of our portfolio mix by sector. Financial services remained our largest sector, at 28% of our total portfolio. Whilst this is down from 30% in the last year, this too has grown in absolute dollar terms. Our exposure in telecom, media and technology grew by 1% over the past year.

This is largely due to the value of our telecom investments and an increase in the value of our telecom investments and the listing of Alibaba. In the life sciences, consumer and real estate sectors, our aggregate exposure is 18%. As I mentioned a few slides ago, this is driven largely by our investments in Gilead Sciences, Olam and AS Watson.

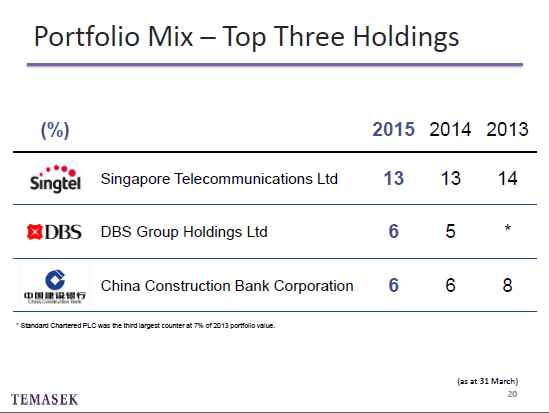

Now let's look at our portfolio from our concentration perspective with our top three holdings. As you can see, Singapore Telecom remains our largest single name concentration position. It's 13% of our total portfolio. This is followed by DBS Bank and China Construction Bank which are both approximately 6% each.

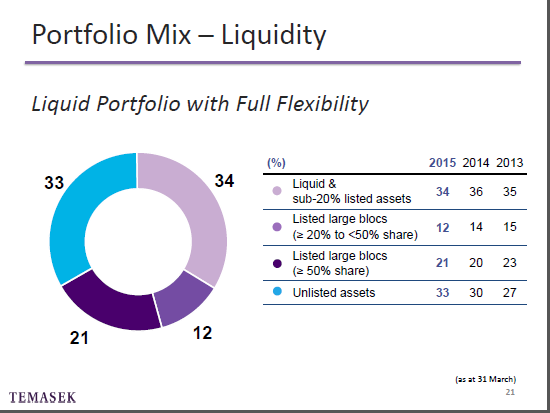

The next slide talks about our portfolio mix by liquidity. Our portfolio remains very liquid. As at the end of March 2015, 67% of our portfolio was held in liquid and listed assets.

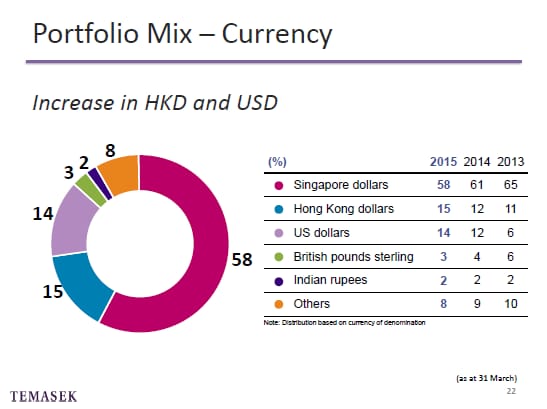

Now let's talk about currency and our portfolio mix by currency. 58% of our total portfolio is denominated in Singapore dollars. For other currencies, primarily are Hong Kong and US dollars which follow, our exposure has increased due to our investment activity in those markets.

That will end our review of the portfolio and the different views in our portfolio.

I will now talk about our near‑term outlook and opportunities that we see relating to the outlook. I have divided this into two parts, the growth markets and the mature markets. For the growth markets we are targeting our investment approach in countries which are committed to structural reform. These include China, India and Mexico.

Let me talk a little bit about China. In China, we are seeing the rebalancing of the economy and we believe this will result in slower, but more sustainable, growth. Also the continued urbanisation and consumption coupled with market reforms will continue to drive long‑term economic growth in China.

In India, we are seeing the Modi‑led Government focused on reviving investment‑led growth. We continue to actively review opportunities in India that fit our investment themes.

Let's now look at the mature markets. We believe that the US economy will continue its recovery path. Corporate earnings and balance sheets are healthy, despite rising equity valuations. There are also several sectors in the US where companies have comparative advantages in the global arena and examples of these are companies in the energy sector, the technology sector and in life sciences. We are focussing on identifying such differentiated businesses as we seek investments.

Now let's talk about Europe, the other mature market. We have seen a pick up in growth primarily on the back of easing credit conditions in Europe in the past year and going forward. We are watchful in Europe and looking for opportunities. Having said that, the political dimension needs to be monitored closely as developments on this front could have some destabilising effects.

The recent developments in Greece, which I'm sure all of us have been reading over the last few years, have led us into unchartered territory. We do not expect contagion in the European financial markets as a consequence of what is happening in Greece and therefore we remain watchful on ongoing developments there.

In conclusion, we continue to be guided by our investment themes as we navigate our target markets and opportunities. We see that innovation is driving many consumer and business patterns across the globe.

In fact, technology itself is enabling many businesses that it did not before. In order to embrace the opportunities of the future we are interested in companies that are at the forefront of innovating new technologies and business models. Such companies, we believe, have the potential to become global champions.

With that, I will pass the time on to Neil who will take us through Temasek's key institutional developments. Neil.

NEIL MCGREGOR: Thanks, Ravi. Good afternoon, everyone. My name is Neil McGregor, Senior Managing Director of the Enterprise Development Group. It's my pleasure to share more with you about our institutional activities over the year.

Our charter sets out who we are and what we do - a guiding ethos, if you like. It clearly articulates our purpose in three roles.

First and foremost we are an active investor and shareholder. We are committed to delivering sustainable value over the long term.

We're a forward‑looking institution. The key words embody several concepts, key of which is that we foster an ownership culture. It puts the institution above self, it emphasises the long term over the short, and aligns the interests of both employees and shareholders.

We are also a trusted steward. We contributed to the advancement of communities across generations.

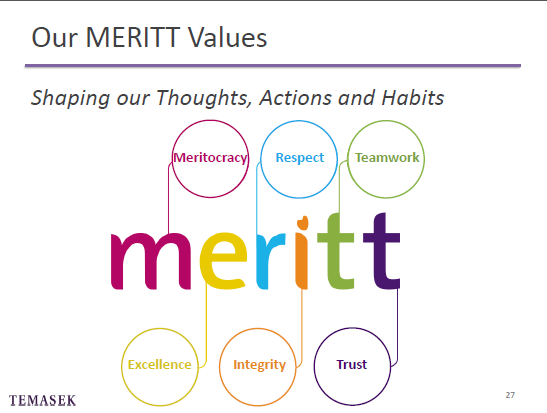

Now, in addition to the charter our MERITT values anchor our organisation. Our staff are guided by them in performing their daily roles. The values are meritocracy, excellence, respect, integrity, teamwork and trust. Integrity, for example, is about being professionally honest in all that we do. Excellence is an ideal that is demonstrated by our constant quest for improvement. These values are best reflected in how we do business in a culture that has an ownership mindset.

At Temasek we are owners of our portfolio and an active investor. We create value across generations. We constantly work to deliver long‑term sustainable value to our stakeholders. This is done through the interaction of four factors ‑ investment strategy, capital allocation, performance management and incentive framework.

Our incentive framework ensures alignment between employee and shareholder interests. It does this by sharing gains and pains. In doing so, we effectively balance short‑term performance and long‑term value creation.

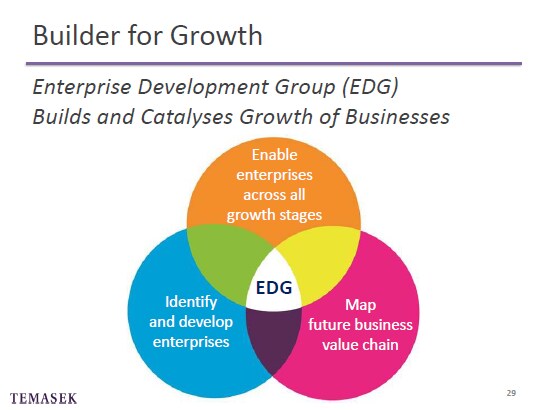

Beyond investing, Temasek also builds businesses. Our Enterprise Development Group, or EDG, enables enterprises across all stages of growth.

We help create, shape and adapt their business models, capturing value along the way. We also look out for, and help develop, enterprises that can be global, regional or domestic champions. We do so by helping them map out their future value chains so that they can stay ahead of trends and disruptors. Taking these all together, that's how we embrace the future.

So, let me illustrate this. First, some examples of early stage investments. In venture capital we invested in funds such as Monk's Hill and NSI Ventures.

Then in the SME sector Heliconia Capital has set up a fund to provide Singapore‑based SMEs with mezzanine financing. In addition, Clifford Capital continues to support Singapore‑based companies in their exports or overseas investments.

Also, Vertex Venture, our VC platform, has a committed capital of US$1.2 billion. Through funds in Asia, the US and Israel, Vertex invests in primary sectors of technology and healthcare.

EDG also looks at opportunities to enable growth and transform businesses. Last year the combination of Cityspring Infrastructure Trust and Keppel Infrastructure Trust created the second largest business trust in Asia.

Additionally, we partnered JTC for the mergers of Singbridge and Ascendas as well as Surbana and Jurong International. This provides an integrated suite of sustainable urban solutions.

Through EDG, Temasek also seeds new businesses. For example, we're partnering with the Singapore Government to rejuvenate Mandai. A multigeneration project the new Mandai will be a haven for Singaporeans and visitors young and old to enjoy nature in a fun and inspiring way. We are taking an integrated, sustainable and inclusive approach. The goal is to revitalise Mandai as a nature destination to celebrate and to protect our biodiversity.

(VIDEO PLAYS)

That gives you an idea of what will become the Mandai experience. Cool, wasn't it?

Now, Temasek is also a trusted steward of our communities. Allow me to share more about what we mean.

Since our inception in 1974 we have established 16 endowments in Singapore and Asia. They are aimed at building people, communities, capabilities and rebuilding lives. These efforts have touched the lives of over 240,000 people.

Here are some of these investments, clockwise from top left.

Temasek Foundation aims to build human and social capital for a more prosperous Asia.

Temasek Cares improves the lives of the underprivileged in Singapore.

Temasek Education Foundation supports the programs that nurture young talent in the areas of sports, mathematics and science, arts and music.

Temasek Lifesciences Laboratory conducts biomolecular science research to the benefit of people in Asia and beyond.

The Wealth Management Institute is Asia's first centre of excellence for wealth management education.

And finally, our staff volunteer outfit, T‑Touch. T‑Touch organises programs for the elderly, ex‑offenders and children with special needs.

Now here's something for you to enjoy. The achievements of Shanti Pereira, who recently won gold in the SEA Games 200 metres women's sprint. Why do I mention this? Well, Shanti is a beneficiary of the EW Barker Endowment, under Temasek Education Foundation. Meet Shanti.

(VIDEO PLAYS)

SHANTI PEREIRA (video): I'm Shanti Pereira and I'm a sprinter. At the SEA Games I ran the 100 and 200. Coming in the race I knew who I was competing against. All I thought about was going there and doing my very, very best no matter what the outcome is. Once the starter says "On your marks" everything goes out of my head and I'm ready to go.

I think that fire in me pushed myself to get the gold medal. I just raised my arms straight away, turned to the crowd and pointed at them. It really felt amazing, like I made my country so proud and I made my family, my friends, all really, really proud.

I'm really grateful for the provision of the EW Barker endowment. It really helps athletes like myself train overseas and gain experience and knowledge and really help me make a quantum leap into better performances in the future.

Right now I'm focussing on the world championships I'm going for in August. After that it will be training and hoping that I will go for the Rio Olympics.

I always follow what my parents and my sisters have told me, which is even though you are so tired from training you have to remember that this is what you love. The most important thing would be to always enjoy the entire process.

(VIDEO ENDS)

NEIL MCGREGOR: Inspiring, isn't she?

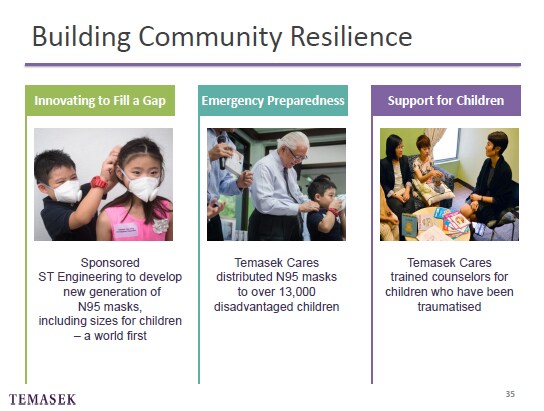

Now, there are some other ways which we contribute to our communities. Some examples include working with ST Engineering to develop a new generation of N95 masks, including sizes for children. These are very effective in reducing the transmission of airborne diseases. These masks have been distributed to over 13,000 disadvantaged children through Temasek Cares and I believe today we also have some of these masks for you.

Temasek Cares also launched a program to train counsellors for children who have been traumatised.

I'm pleased to say that Temasek is now on Twitter, Linked‑In, Facebook, YouTube and Instagram. These new platforms may give you insights into who we are and what we do.

With that, let me conclude by saying as an active investor and a forward‑looking institution and trusted steward, we embrace the future.

Thank you very much.