Embracing change, realising potential

Embracing change, realising potential

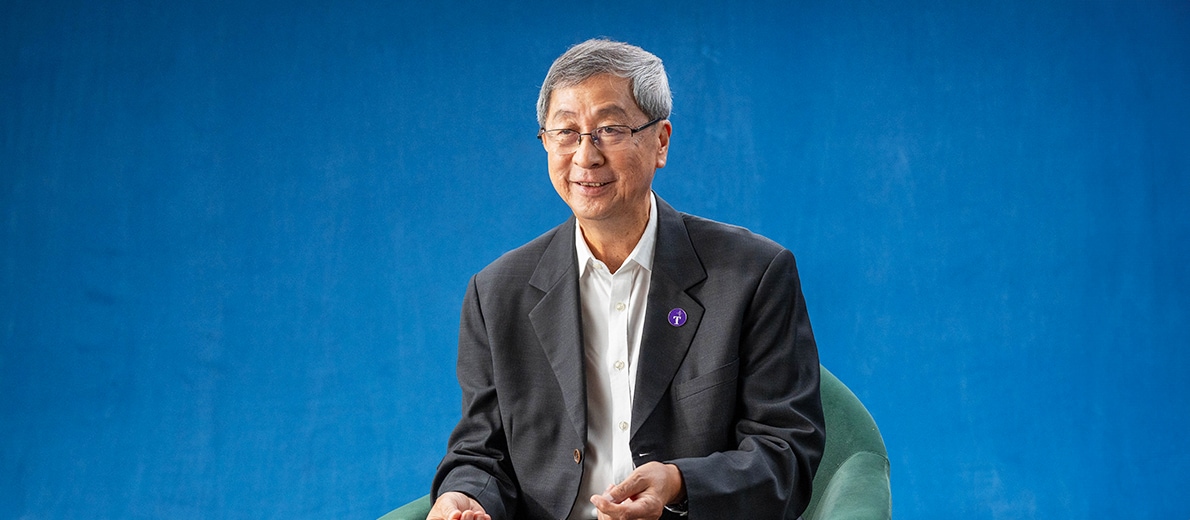

As she prepared to step down as CEO of Singapore Technologies (ST) in the early 2000s, Ho Ching had a very different future in mind – early retirement. But S Dhanabalan, then Chairman of Temasek, called to convince her that “me time” could wait.

“I think it was because I had once told him that Temasek should be doing what we were doing in ST. That was the arrogance of youth,” she laughs.

During her 14 years at ST, the electrical engineer helped transform a diverse portfolio of companies, reimagining, consolidating, and turning around businesses.

It was precisely the kind of bold imagination and risk-taking that Dhanabalan felt Temasek needed to be an active investor. It took some convincing, but in January 2002, Ho Ching joined Temasek’s Board, first as Director, and then Executive Director, before becoming CEO in 2004.

Instead of simply charging forward, she spent her first year at Temasek pulling box files and manila folders from Temasek’s filing registry. She ploughed through decades of meeting minutes and Board papers, and uncovered a history defined by continuous change and evolution.

“When you go to a new place, you have got to respect the institution and its people, and try to understand where they’re coming from,” she explains. “What came through clearly was a picture of a young company searching for a meaningful role. There was a strong sense of people wanting to do better, do good, and rise to the challenge. That was, to me, the DNA of Temasek.” This resonated with her.

On this foundation, she would build a culture of continuous learning, experimentation and adaptation. This relentless commitment to staying ahead of the curve would become a hallmark of her 17-year tenure as Temasek’s CEO, and underpin her style of decision-making and nurturing talent.

Normalising flux

Ho Ching’s first task as CEO was to ignite the ambition to double Temasek’s asset base by the turn of the decade, an audacious goal of “Temasek 2010”, or T2010.

Rather than a prescriptive roadmap, Ho Ching prioritised building a culture of innovation, an openness to embracing challenges, and the courage to seize opportunities and test boundaries.

“We set ourselves a target of having a ‘new’ Temasek every three years – it was ambitious and unsettling, but it was a way to adapt and remain relevant. It made people comfortable with the idea of change, and stepping out of their comfort zones.”

“Even as we did the day-to-day, we had an idea of the longer-term horizon that we were navigating towards. We knew Asia was ready to take off and could feel that pulse, that potential,” she says.

Ho Ching urged what she calls “peeling the onion” to progressively build trust by explaining what Temasek did, and why. Temasek made public its portfolio performance for the first time in 2004, and annually thereafter.

“To invest outside Singapore, we need to be transparent about who and what we are, so having this annual review was important,” she says. “It is an engagement with the Singapore public, but it is also an engagement with the outside world.”

We set ourselves a target of having a ‘new’ Temasek every three years – it was ambitious and unsettling, but it was a way to adapt and remain relevant. It made people comfortable with the idea of change, and stepping out of their comfort zones.

Ho Ching

A sustainable blueprint for success

By the turn of the decade, Temasek had embraced emerging Asia, with offices in China and India, and dealt with the fallout from the 2008 global financial crisis.

It also saw promising new technologies emerging in the US and Europe. To capitalise on these global trends, Temasek embarked on T2020, its second 10-year ambition, and grew to become a trusted international investment house.

“All our plans follow the practice of very seriously reviewing what comes next. The world is changing – and very fast. Asia, itself, is changing quickly. There will be shifting forces, from geopolitics to technology. We need to keep pace and, ideally, anticipate changes and place ourselves ahead of them,” she says.

This included recognising the importance of sustainability for long-term resilience. Ho Ching argued passionately for incorporating environmental considerations into investment decisions, in addition to people and governance factors.

“I think of Temasek as an intergenerational investor, which means we have a responsibility towards people who may not be born yet, or who may not be in your organisation,” she says, adding that this meant Temasek had to act proactively on the risks and opportunities presented by climate change.

Through its annual Ecosperity conference, launched in 2014, Temasek championed the twinning of ecological and prosperity goals. Operationally, it factored a carbon price into its investment decisions, and drove portfolio decarbonisation efforts. In 2019, Temasek set an ambitious target to halve net carbon emissions attributable to its investment portfolio by 2030 compared to 2010 levels, and aim towards net zero emissions by 2050.

“If a country like Singapore and a company like Temasek didn’t make a start, then few others would. So let’s do what we can – and if by that, we can inspire others to do more, we would have done something,” Ho Ching says.

It’s no different from how Temasek acts as a community steward, anticipating needs and focusing its resources and strengths towards addressing them, she explains.

Even when a mysterious pneumonia outbreak in early 2020 seemed like a distant threat to Singapore, Temasek took action. “Most of us think linearly, but this looked like it could be an exponential challenge – cases could explode from one to two to four within days, and to hundreds within weeks. We needed to be prepared,” she says.

Ho Ching urged the team to look “five steps ahead” in anticipating runaway pressures on the healthcare sector. By the time patient numbers surged, a blueprint was ready. Within six days, two Singapore Expo halls were converted into a medical-grade care facility with hundreds of cubicles for patients. This was swiftly expanded to over 8,500 cubicle-beds across 10 halls.

With the right resources in place, Temasek could get help to where it was most needed. A S$40 million Temasek Emergency Preparedness Fund (T-PREP), established in 2014, meant critical items like surgical masks, hand sanitisers, and oximeters could be quickly procured for the public. It also put diagnostic and oxygen equipment into the hands of healthcare workers, both in Singapore and in neighbouring countries.

“We were thinking ahead,” she says. “If you only start looking for solutions at the point of need, you’re already too late.”

“We were thinking ahead,” she says. “If you only start looking for solutions at the point of need, you’re already too late.”

A legacy of leadership

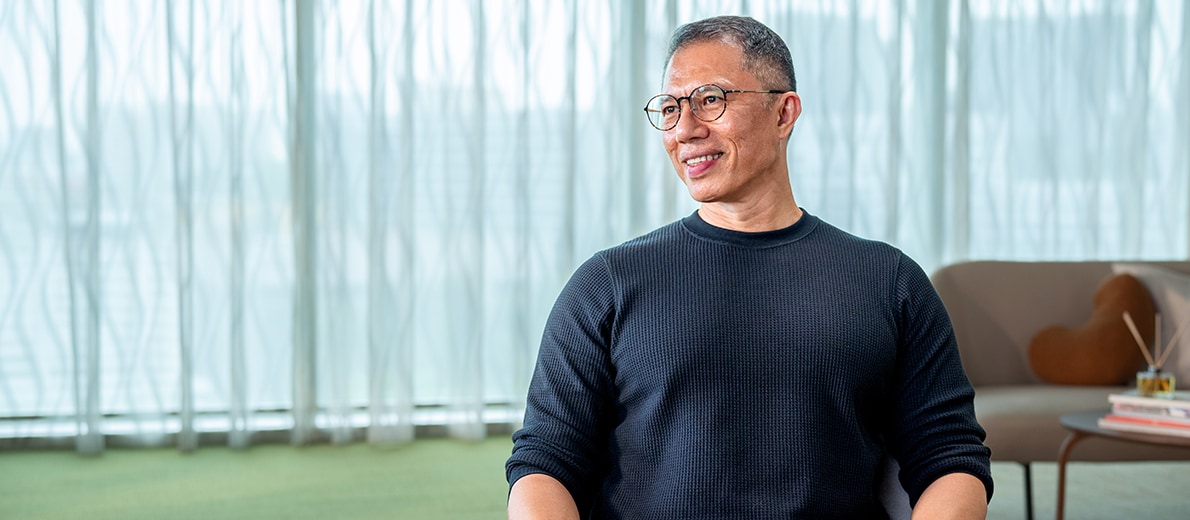

By the time Ho Ching handed the reins to incoming CEO Dilhan Pillay in October 2021, Temasek’s net portfolio value topped S$380 billion, up from S$90 billion in 2004. What began as a local holding company had grown into a reputable investment company. Temasek had also expanded its interests into new sectors such as life sciences and non-bank financial services; sustainability was embedded in both its operations and investment decisions.

But her most memorable Temasek moment came a year after she retired to become chairman of Temasek Trust. Under Dilhan’s leadership, Temasek had embarked on a company exercise to crystallise what the firm stood for. It landed on the purpose ‘So Every Generation Prospers’.

“Temasek staff, whether in Singapore or New York, Mumbai or Beijing, unanimously committed to future generations, to something larger than themselves. That’s the core of Temasek – the institution, the people it attracts, and the people it has nurtured,” she marvels.

It was a purpose that resonated with the aspirations in the manila folders she read when she first joined.

“I never knew exactly what the ‘new’ Temasek would be, just that it always wanted to do more, do better, and with the larger picture in mind, from day one,” she reflects.

“What new animal do we want to create? I hope this ceaseless search for relevance remains – it will help keep Temasek agile and adaptable, with its eye on the horizon, even as it evolves and strives for a greater tomorrow.”

I think of Temasek as an intergenerational investor, which means we have a responsibility towards people who may not be born yet, or who may not be in your organisation.

Ho Ching

As we mark our 50th anniversary, we present 50 stories from our staff, alumni, and beneficiaries who have been a part of Temasek's journey through the years.

Hear for the first time their anecdotes of what went on behind the scenes as they grew alongside the firm. Together, they capture pivotal milestones of Temasek, and tell the story of an institution built By Generations, For Generations.