As Global Complexity Grows, How Can Businesses Better Navigate Uncertainty?

As Global Complexity Grows, How Can Businesses Better Navigate Uncertainty?

The world faces significant challenges like persistent inflation, workforce disruptions and heightened geopolitical tensions

Having a clear purpose that focuses on investing in human potential and driving solutions that enable a more sustainable future can help.

The post-pandemic world isn’t what Ms Amanda Wong, 29, envisioned it to be. She perceives life to have become more complicated than it was three years ago, leaving the digital marketer uneasy.

Ms Wong, who lives with her parents in a four-room Housing Board flat, elaborates: “Cost of living has been on our minds for a while now, with inflation and higher interest rates straining our household budget.

“Reports of extreme weather events due to climate change seem to be becoming more frequent too.” She’s also worried about job security with the rise of automation and artificial intelligence (AI).

Ms Wong’s concerns mirror those of businesses, which also face uncertainties amid rising complexity.

There are other issues on the horizon:

- Heightened geopolitical tensions, including the Israel-Hamas war, Russia’s invasion of Ukraine and the widening US-China rivalry, will have far-reaching effects, devastating livelihoods and lives;

- Stricter foreign investment regulations that can lead to global output losses, disproportionately impacting developing economies;

- Cyber risks as the world becomes more reliant on technology. This will make cyber resilience necessary for businesses.

Climate change remains one of most pressing concerns for the world.

How can we chart a steady course forward? For Singapore-headquartered global investment company Temasek, the solution lies in its T2030 strategy, described as its “compass in a complex world”.

“The strategy reflects the importance we place on staying agile and being adaptable,” says Ms Png Chin Yee, chief financial officer of Temasek, “as it guides how we probe, sense, and respond to the changing environment with clear thinking and judgement while anticipating what lies around the corner.”

At the core of its strategy is its purpose. “It is a single, unifying pledge that guides us in everything that we do – think intergenerationally, and build a better, more inclusive and sustainable world,” says Ms Png.

Our purpose, ‘So Every Generation Prospers’, reflects our aspiration to help every generation thrive by empowering the well-being of our people, portfolio companies, partners, communities, and the planet we share as a common home.

Ms Png Chin Yee, Chief Financial Officer, Temasek

Purpose: Why Temasek exists

The world is shifting. Temasek’s purpose, “So Every Generation Prospers”, emphasises that companies today must be driven by a mission that goes beyond profit, says Ms Png. “We believe that our long-term success as a global investor is contingent on the presence of thriving businesses and economies; cohesive societies and communities; and resilient people and planet.”

She shares more about the company’s purpose principles:

Investing in human potential: Temasek actively embraces diverse perspectives and skill sets, empowering the linear and lateral thinking of its people and ecosystem to realise their fullest potential, individually and collectively.

Catalysing solutions: By focusing on effective problem-solving and investing with integrity, Temasek aims to mobilise financial, human, natural, and social capital to transform complex challenges into opportunities.

Building with courage: With conviction and courage, Temasek seeks to turn ambition into actions that chart a course for those who come next.

Growing for generations: Temasek aims to steward and grow its portfolio, the communities it operates in, and the future by creating positive outcomes that will outlive us all.

Temasek is guided by its purpose principles, which are investing in human potential, catalysing solutions, building with courage and growing for generations.

Portfolio: How it delivers long-term returns

Through its investments, Temasek aims to drive solutions that can help companies transition to a more sustainable future, tap opportunities to invest in future growth sectors and business models, and encourage enterprises to transform through efforts in innovation, says Ms Png.

Its $382 billion portfolio, with a 20-year total shareholder return of 9 per cent as at 31 March 2023, has two parts: A resilient component designed for long-term stability and sustainable returns, and a dynamic portion where investments may have a shorter duration, and capital is reinvested for higher returns.

Three growth engines drive this diversified portfolio.

1. Investment engine (86%): Consisting of long-term holdings in key Singapore-headquartered portfolio companies, and global direct investments, including growth equity in companies with potential to be market leaders.

Think of local enterprises like Singapore Airlines and CapitaLand; and global entities like investment company BlackRock, health and beauty retailer A S Watson and medical device maker ThermoFisher.

2. Partnership engine (10%): To scale capital for stable, sustainable returns, Temasek partners asset management platforms, which provide financing solutions like private equity, private credit, public market investing and capital solutions.

Examples include Fullerton Fund Management and Azalea Asset Management, which are part of Seviora Group; 65 Equity Partners; Heliconia Capital; and Decarbonization Partners, a joint venture with BlackRock that focuses on decarbonisation solutions.

3. Development engine (4%): To remain agile and adaptable, Temasek anticipates future needs and invests in cutting-edge technologies and transformative solutions, in areas such as AI, cyber security and sustainable energy.

A greener, more liveable future

Sustainable scenarios: How will emerging green technologies transform our lives? Peek into the future with these solutions that can help us fly more sustainably and keep our produce fresher.

Bold initiatives: A global survey found that three-quarters of young people are “frightened” of the future due to climate change. Explore how businesses are stepping up on climate action to help.

People: How it relates to you

Temasek's actions impact our lives more than some may realise. It does so in two ways:

Budget: It contributes to the Singapore Government’s Budget through corporate taxes and the Net Investment Returns (NIR) framework. The NIR is estimated to contribute 20 per cent to the Singapore Budget for the financial year ending March 2024.

The NIR framework allows the Government to use up to 50 per cent of the long-term expected real returns (including capital gains) on net assets invested by GIC, the Monetary Authority of Singapore, and Temasek. This helps meet both current and future needs while boosting Singapore's reserves.

Philanthropic initiatives: Since 2003, Temasek has been setting aside some of its net positive returns above its risk-adjusted cost of capital for community gifts to support the progress, cohesion, and resilience of communities.

The philanthropic funds are gifted to Temasek Trust, which then distributes them – based on the principles of sustainability and good governance – to Temasek Foundation and other non-profit entities to support programmes on a sustainable basis.

To date, these programmes have helped about 2.5 million people in Singapore and beyond.

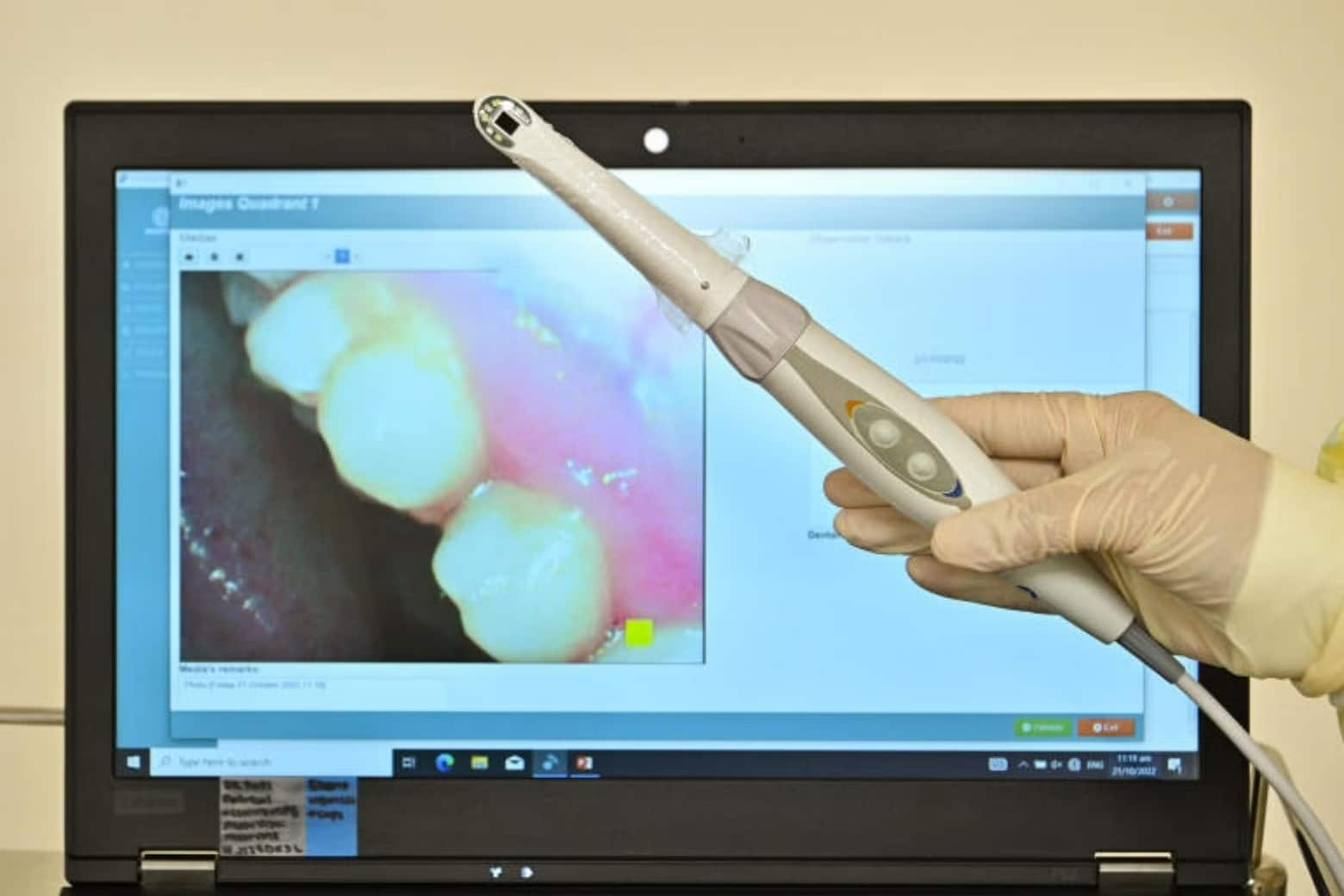

The Tele-Dentistry Oral Care for Seniors (T-DOCS) programme, piloted by the National Dental Centre Singapore and Temasek Foundation, aims to improve access to preventive oral care for vulnerable seniors enrolled in home care programmes or staying in nursing homes.

What is the T2030 strategy?

It is Temasek’s 10-year roadmap to guide its decision-making, strategic planning, capability building and institutional development initiatives.

It comprises four key pillars, underpinned by three foundational enablers. The four pillars are:

- Resilient and forward-looking portfolio: Temasek’s strategy revolves around constructing a resilient portfolio that can withstand external shocks and market volatility while focusing on sustainable returns over the long term.

- Sustainability at its core: Recognising the urgency of climate action, Temasek embeds sustainability in everything it does – from its mandate to deliver sustainable returns over the long term to building sustainable businesses.

- Temasek Operating System: It is building specialised capabilities in AI, blockchain, cyber security, data and digital, and sustainable solutions to meet the challenges of tomorrow, and bring value to its ecosystem and the wider marketplace.

- Organisation, talent and capabilities: To achieve its ambitions, Temasek is focusing on organisational and talent development to grow its people, capabilities, and teams for the future.

The three foundational enablers are:

- Catalytic capital: Temasek deploys catalytic capital to deliver sustainable value over the long term across financial, human, social, and natural dimensions.

- Networked organisation: Collaboration is key. Temasek collaborates with its ecosystem of partners, leveraging their deep expertise to amplify financial and social impact.

- Purpose, culture, values: It focuses on instilling purpose, fostering a culture of teamwork, and cultivating a strong set of values to navigate the decade ahead.

Source: The Straits Times © SPH Media Limited. Permission required for reproduction.