Letter to Business Times: How and Why Temasek Uses a Hurdle Rate

We thank Kenneth Lim for his mention of Temasek's hurdle rate in the Hock Lock Siew column of your newspaper on Friday 15 July. It may interest your readers to know why and how we use a hurdle rate.

Temasek does not have a firm-wide hurdle rate or investment return target. The hurdle rate we report in our Temasek Review every year is simply an average of the risk-adjusted hurdles for each of our investments, weighted by size.

We use a risk adjusted cost of capital approach as one of our criteria to make our investment decisions and to track our performance on a bottom-up, or investment by investment, risk-aware basis.

For each investment, we estimate the risk premium associated with its sector and country. This approach allows us to compare various investment opportunities, normalised for risk: comparing apples with apples, if you like.

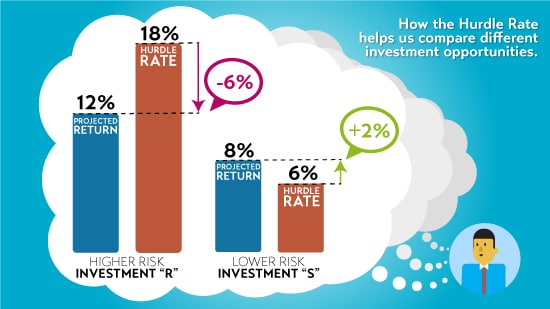

For example, consider an investment, R, with a projected return of 12%, and an investment, S, with an 8% projected return.

Should we invest in the 12% R or the 8% S?

To compare the two, we determine their risk adjusted hurdle rates based on their respective country and sector.

Say, R has a hurdle of 18% due to higher risks, while S has a lower hurdle of 6%.

Thus, the 12% of R is 6% below its 18% risk adjusted hurdle; while the 8% of S exceeds its 6% hurdle by 2%.

Hence, on a risk-adjusted basis, we would favour investment S over investment R, despite the seemingly more attractive 12% return of R.

Of course, if both opportunities have the same risk adjusted hurdle, we would prioritise the higher return one.

This approach provides a conscious check against unknowingly taking excessive risks to drive returns.

It does not guarantee that the actual returns will be as we projected, but gives us a basis to judge the relative attractiveness of various opportunities.

We report our returns over various durations, along with the respective aggregated risk adjusted hurdles for the corresponding periods. This gives a sense of our returns relative to the risks taken. These hurdle rates are by no means a single uniform hurdle, or a target return rate, for all investments, regardless of their specific risks.

Stephen Forshaw

Managing Director, Public Affairs