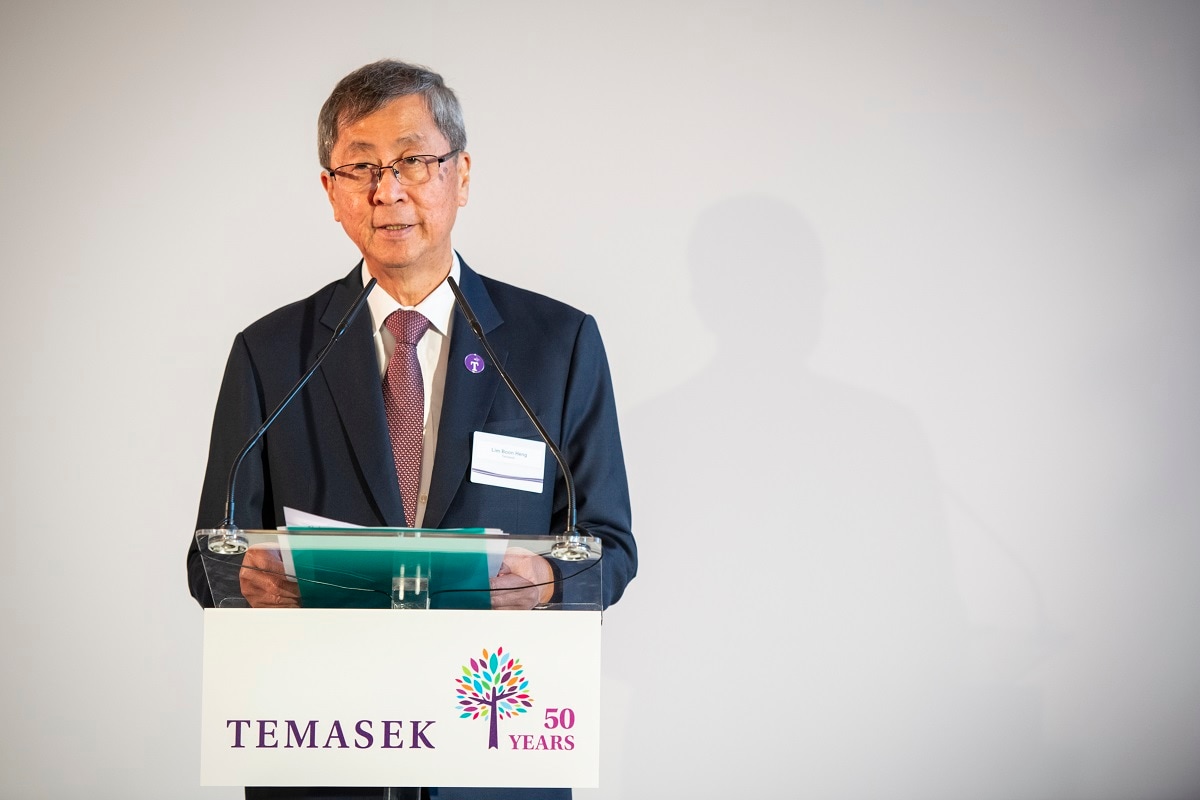

Speech by Mr Lim Boon Heng, Chairman of Temasek, at the Reception to mark the Launch of Temasek’s Paris Office

Temasek Chairman, Lim Boon Heng, delivering the opening address at the Temasek Paris Office opening reception on 10 April 2024.

Deputy Prime Minister and Minister for Finance of Singapore, Mr. Lawrence Wong

Minister for Foreign Affairs of Singapore, Dr. Vivian Balakrishnan

Minister for the Economy, Finance, Industrial and Digital Sovereignty of France, Mr. Bruno Le Maire

Minister for the Interior of France, Mr. Gérald Darmanin

Her Excellency, Ambassador of Singapore to France, Mdm Foo Teow Lee

Her Excellency, Ambassador of France to Singapore, Ms. Minh-di Tang

Partners, Friends, Ladies and Gentlemen,

Thank you all for joining us this evening, at the heart of the beautiful city of Paris.

It was good timing for us that our Deputy Prime Minister and Minister for Foreign Affairs had planned to be in Paris, and are able to grace this event. We are also honoured that Minister Bruno Le Maire and Minister Gérald Darmanin accepted our invitation to join us. We are grateful for your presence.

And to you, our distinguished guests, thank you for making the time to mark this joyous occasion with us.

The opening of our Paris office is a significant milestone for Temasek. It is an integral part of our 2030 strategy, which is to expand our global network, construct a resilient portfolio, and grow our organisation, talent and capabilities, with sustainability at the core.

Our Paris office will complement our London and Brussels offices to strengthen Temasek’s global network. It will enhance our access to deal flow and partnership opportunities, and grow our talent pool across EMEA.

The opening of our Paris office today also reaffirms our commitment to the region. The significance of this region to Temasek cannot be overstated. Our exposure to the EMEA region has grown almost five times since 20111 (in Singapore dollar terms), reflecting the dynamic opportunities and innovation we see here.

Ten years ago, we opened our London office, which was our first office in Europe. You may recall that Europe still faced economic uncertainty coming out of the Global Financial Crisis as well as the financial crises affecting Portugal, Ireland, Italy, Greece, and Spain at that time. Even then, I said that Temasek saw a deeper purpose in providing a bridge between Europe and Asia, and partnering European companies, both inside and outside Europe.

We have come a long way, and today we celebrate this milestone of opening our Paris office. To complement this, we have a leadership transition with Nagi Hamiyeh succeeding Uwe Krueger as Head of EMEA for Temasek. Nagi will partner with Benoit Valentin to grow our EMEA portfolio and presence. I would also like to thank Uwe for continuing to help us with our networks and partnerships in the region as Vice Chairman of EMEA.

Our growth in this region would not have been possible without the support and trust of our partners and friends, as well as the distinguished industry leaders on our Temasek European Advisory Panel who have shared their insights with us through the years.

At Temasek, our investment activities are aligned to four structural trends, which shape our long-term portfolio construction. Digitisation and Sustainable Living are two megatrends that we see will have a pervasive impact on all business sectors. The other two trends are Future of Consumption and Longer Lifespans, and they reflect the structural shifts in consumption patterns and growing needs as the world evolves.

Guided by these trends, we have invested in innovative EMEA companies such as Element Materials and Busy Bees in UK, Boortmalt in Belgium, Topsoe in Denmark, BioNTech in Germany, and Adyen in The Netherlands. They have all successfully grown to become market leaders in their respective fields.

Here in France, we are inspired by the vibrancy of the innovation ecosystem and have forged partnerships and investments across the four trends, ranging from Alan a digital health insurer, ManoMano an e-commerce marketplace, Tikehau Capital an alternative asset manager, Ceva and InnovaFeed in sustainable agriculture, and PASQAL in quantum computing. In particular, we partnered with Schneider Electric to expand their India presence, enhancing their manufacturing footprint to serve the large India market.

Going forward, cognisant of Europe’s leadership position in energy transition technologies, we will also be focusing on investment opportunities aligned to this trend. This is part of our commitment to contribute towards accelerating the world’s net zero journey.

Ladies and gentlemen, this year is also a special year for Temasek. We commemorate our 50th anniversary since our inception in 1974. We have always said that we do things today with tomorrow in mind, so that our future generations can prosper. What this means is that we aspire to help every generation thrive by empowering the well-being of our people, portfolio companies, partners, communities, and our planet.

This is especially important in today’s context. The global landscape is fraught with complex and interconnected challenges on various fronts. To resolve the most pressing challenges of our time, we need to join hands in partnership, build resilience, and unlock exponential growth, so every generation prospers.

Before I end my speech, I would like to invite you to take a moment to immerse yourselves in the beauty and history that surrounds us tonight. May you find inspiration in contemplating the parallels between the art that transcends time, and the impact that we strive to make through our endeavours.

Thank you once again for your friendship and partnership, and for being with us here tonight.

Merci beaucoup.

1 As at 31 March 2023, Temasek’s underlying portfolio exposure in EMEA, predominantly in Europe, is 12% (~€32 billion/~S$47 billion). As at 31 March 2011, it was 5% (~€5 billion/~S$10 billion). It was 9% (~€12 billion/~S$20 billion) in 2014, the year Temasek opened its London office.