Keynote Address by Leong Wai Leng, Chief Financial Officer, at the 5th Asian Bond Markets Summit

Pan Pacific Hotel, Singapore

Introduction

- Good morning ladies and gentlemen.

- I am delighted to be here to speak with all of you this morning at this 5th Asian Bond Markets Summit. And those who have flown in especially for this Summit, welcome to Singapore.

- The organisation of this Summit on the Asian bond markets with a theme focusing on “building for the future” by the Asset and the ADB could not be more timely and appropriate.

Overview of the Asian Bond Markets

- As reported by the ADB, despite the worst global financial crisis in 2008/2009, the outstanding Asia bond market issuances, excluding Japan, totalled some US$ 5 trillion as at the end of 2009, or nearly 15 times the level at the start of the Asian financial crisis in 1997.

- Despite the sovereign debt crisis in Europe, the growth of the Asian bond markets as a funding source has continued into 2010. According to ADB, the total outstanding Asian issuances, excluding Japan, continued to grow in excess of US$ 5.5 trillion as at the end of the first half of 2010.

Temasek's Issuances

- In the ten months between October 2009 and July 2010, Temasek issued ten bonds totalling almost S$ 8 billion. Six were denominated in Singapore dollars, two in US dollars and two in Sterling.

- I would like to take this opportunity to share with you our learnings from the issuances, in particular our six issuances in the Singapore dollar market, as well as my thoughts on the opportunities in the Asian bond markets.

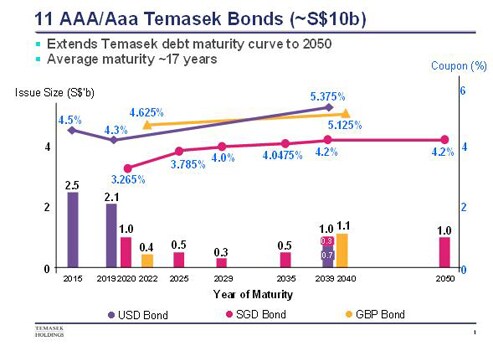

- The slide that you have just seen, shows Temasek's outstanding bond issues. The bars show the size of the issues in Singapore dollars, and the lines show the coupon rates. Our Singapore dollar issuances are in pink, our US dollar issuances in purple and our Sterling issuances in yellow.

- Including our maiden US dollar bond issued in September 2005, we have 11 outstanding bonds totalling slightly over S$ 10 billion, with a weighted maturity of about 17 years.

- These issues allowed us to establish our Singapore dollar, US dollar and Sterling yield curves, and extended our debt maturity curve to 40 years up to 2050.

- I would, at this juncture, like to take this opportunity to thank all investors who have supported us in our various bond issues. I notice several friends and investors in the audience today and I would like to take this opportunity to extend a personal thank you to you for your support.

Why Temasek Issues Bonds

- At this juncture, I would like to take a couple of minutes to explain the broader objectives of the Temasek Bond Programme.

- Temasek’s Bond Programme, together with our annual Temasek Report and credit ratings, are public markers we have put in place since 2004 to ensure and reinforce focus and long term financial discipline.

- Besides raising funds, enhancing our capital efficiency, and increasing our funding flexibility, our bond issuances require us to engage another stakeholder base comprising both international and Singapore bondholders, and foster the financial discipline that is required to do so.

- As an exempt private company, Temasek is not required to publish our performance and financial results. However, in October 2004, we chose to publish our first Temasek Report, and have been doing so annually since then.

- In the same year, we chose to be rated by Moody’s and Standard & Poor’s and continue to be credit rated ever since. This establishes a public marker of our financial position and credit risks.

- We then set up our MTN programme and issued an international 10-year US dollar bond in September 2005. This established our third public marker, as our bond spreads are a real-time indicator of our credit risks, much like the role of a singing canary in a coal mine. This was also a deliberate move to require us to engage a new group of sophisticated stakeholders.

- Today, we have these three sets of public markers; our annual Temasek Report, our credit ratings, and our bond spreads. The Temasek Report is like our score card at the 18th hole after a long game of golf, our credit ratings the tripwires or OB markers, and our bond spreads our own singing canary. We believe these are important to lay the foundations for a robust and disciplined institution for the future.

Temasek's Experience in the Singapore Bond Market

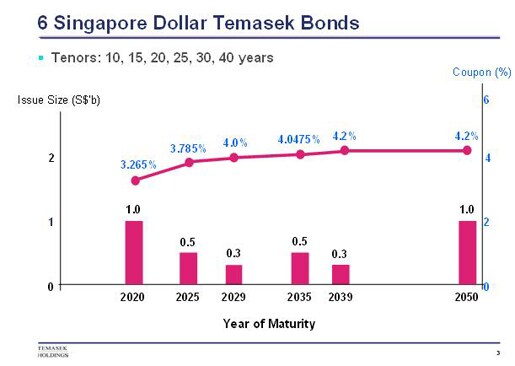

- Let me now return to Temasek’s experience in the Singapore bond market. Temasek recently issued six Singapore dollar bonds, with tenors from 10 to 40 years. I would like to take this opportunity to share with you some key takeaways from our experience in accessing the Singapore bond market.

- Our experience has shown that the Singapore bond market has been developing rapidly in recent times, and presents many interesting opportunities for issuers and investors.

- We entered the Singapore dollar bond market in December 2009 with our first two issues of S$ 300 million each, in the 20- and 30-year tenors. These issues were rapidly taken up by institutional investors in under 2 hours.

- Once we established that long term funding at competitive rates was available, we issued a benchmark S$ 1 billion issue in February 2010, on an accelerated book-build basis, in the sweet spot of 10 years. The book was rapidly oversubscribed and we closed the book in under five hours, just after European markets opened and before Asian markets closed.

- The deal attracted over 50 investors ranging from financial institutions, insurance companies, asset managers, trading desks, private banks and corporates. These investors were mainly from Asia.

- We then followed-on with issues in the 15- and 25-year space in March 2010, in response to interests from investors for these tenors. Like the previous issues, the books were closed within the day.

- Finally, we pushed the boundary and issued a landmark 40-year Singapore dollar bond in July this year. This was also on an accelerated book-build basis, with interest coming from over 50 accounts in Singapore and Hong Kong. We launched the issue at 9.30am Singapore time, just after the Singapore market opened and had to close the books early, around lunchtime, as the orders were pouring in fast and we only had a billion dollars of bonds to allocate.

- With our issues in the 10-, 15-, 20-, 25-, 30- and 40-year tenors, we now have a well defined and tight yield curve at the long-end.

- For some time, the perception has been that the Singapore market is not attractive for corporate issuers as it does not accommodate large sizes and tenors beyond 10 years.

- I would just like to share three key takeaways from our experience issuing in the Singapore market which I hope will show that these are no longer constraints.

Key Takeaway #1: Size is possible

- Key Takeaway number one. Size is possible.

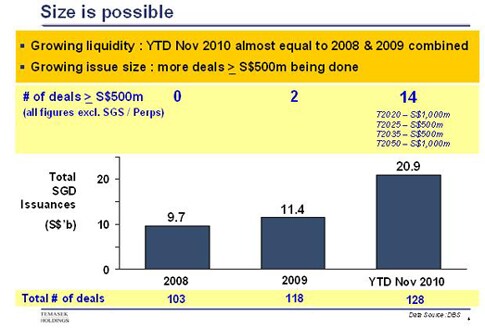

- The slide shows the amount of Singapore dollar bond issues from 2008 to October 2010. The data, from DBS, includes issues by corporates, statutory boards, banks and agencies, but excludes Singapore Government Securities and bank perpetuals.

- In terms of Singapore dollar issuance volumes, the total for just the past 10 and a half months of S$ 21 billion is almost equal to the total two-year issuances in 2008 and 2009!

- What is more interesting is the size of issuances. You can see from the yellow box that that the number of deals with sizes of S$ 500 million or larger has increased from zero in 2008 to 14 in 2010! This includes Temasek’s four bond issues in 2010. Our other two Singapore dollar issues in 2009 were S$ 300 million each.

- I thought what is more interesting is that besides Temasek, Singapore Telecoms, Singapore Press Holdings, Singapore Airlines, Singapore Power, Keppel Corp, City Developments, Land Transport Authority, Housing & Development Board, and Khazanah, have all issued bonds with sizes in excess of S$ 500 million this year. These large issues have been well received by the market, which demonstrates that size is possible.

- In addition, many more issues this year have been placed out to real market investors via a book-building process, which is another sign that the Singapore bond market is becoming more developed.

Key Takeaway #2: Long tenors are possible

- Key Takeaway number two. Long tenors are possible.

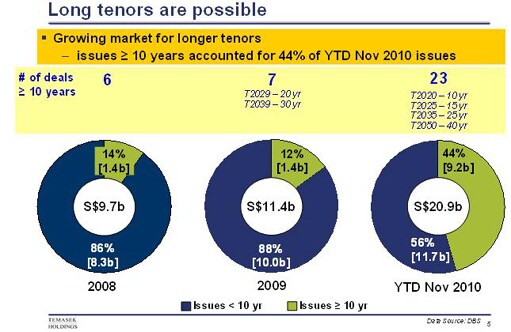

- I like to share with you some data on this slide that shows the breakdown of the Singapore dollar issuances by tenor. There is a growing market for longer tenors, as can be seen from the charts plotted based on data from DBS. The number of issuances in tenors of 10 years and beyond grew from six in 2008 to 23 in 2010, which included Temasek's issues. Issues with tenors of 10 years and beyond accounted for almost half the issuances in 2010, compared with only 14% of total issuances two years ago.

- The stretching of the tenors up to 40 years by Temasek's issue, with demand outstripping supply, shows that long tenors, even beyond the longest Singapore Government Securities of 20-years, are possible.

Key Takeaway #3: Increased Liquidity and Investor Diversity

- Key Takeaway number three. The liquidity pool is deep and there has been an increase in the diversity of investors.

- Just to illustrate, Temasek’s 10-year issue drew in more than 50 investors in less than five hours of accelerated book-building, while our 40-year issue drew interest from private banks and new investors who had not participated in our previous bond issues.

- This increased investor diversification also provided for more active secondary market trading of the bonds.

Opportunities in the Asia Bond Markets

- I would then like to touch on the final section of my speech – my quick thoughts on the opportunities in the Asia bond markets.

- The Temasek issues and the many Singapore dollar bond issues in the last two years show that the Singapore bond market has the liquidity and can accommodate size and tenor. This makes Singapore dollar bonds a possible funding source for local and foreign issuers and investors.

- The increased number of Singapore dollar bonds has also created new benchmarks for the market to price off, and the availability of a Singapore dollar corporate yield curve all the way to 40-years can serve as a real-time fair reference point for both investors and issuers.

- Other developments in the Singapore bond market include initiatives by the Singapore Exchange, or SGX, to promote the listing and trading of fixed income instruments on the SGX to facilitate the development of the market. Last month, SGX introduced the trading of corporate bonds in smaller denominations to facilitate issuers to access the Singapore retail liquidity.

- These initiatives in Singapore, as well as the initiatives being taken by the various Asian countries, bode well for Asia to develop into a bond market hub. And the data shows that Asia bond markets have been developing in the right direction.

- According to a Morgan Stanley’s research report, 2010 is likely to be another year of record issuance as 2009 was. This record supply has been, and is expected to continue to be absorbed by record demand in Asia. More than half of non-financial issuances this year have been first-time issuers, reflecting a broadening market.

- The good news for issuers is that the demand side is growing faster than the supply side. Morgan Stanley’s research shows that inflows into funds that can buy Asian credit have never been even close to the current volumes. The current run-rate into Asia dedicated funds and Emerging Market funds are more than four times historical boom-time average.

- The rapid growth and development of Asian bond markets as a significant alternative funding source for issuers and investors is important and welcome. As many of us know, over the next 3 years, the market expects some US$ 17 trillion of public debt refinancing and budget deficit funding obligations to come due from US, UK, Japan, and Eurozone. The Asian and Singapore bond markets would provide corporate issuers alternative markets to meet their requirements.

- I know you have ahead of you a full agenda to discuss important issues such as how to build sustainable financial markets in Asia, how to enhance onshore and offshore issuers’ abilities to tap the growing Asian bond markets, how to improve infrastructure, regulations to facilitate the development of the markets. Your deliberations will contribute to the development of the Asia bond markets.

- On this note, I would like to wish you all a very fruitful Summit.

- Thank you very much.