Oversight, Ownership, and Accountability

Our internal governance approach ensures oversight, ownership, and accountability over our sustainability initiatives.

Temasek achieved full marks and remained in the top tier of the major State-Owned Investors surveyed by Global SWF. The GSR Scoreboard is a comprehensive analysis of the Governance, Sustainability, and Resilience (GSR) practices of major State-Owned Investors including sovereign wealth funds and public pension funds. The assessment tool was first introduced by Global SWF in 2020 to jointly address important aspects such as transparency and accountability, impact and responsible investing, and long-term survival. It has become a widely recognised metric among sovereign and pension funds globally and one barometer of the industry’s best practices. Temasek is among the world’s Top 200 sovereign wealth funds and public pension funds being assessed.

Board Oversight

Our Board provides overall guidance and policy directions to management. This includes setting out the strategic direction and overseeing the performance and progress of sustainability initiatives that drive long-term value creation for our stakeholders.

The Board has separate and independent access to information to assist it with its deliberations, including the opportunity to request supplementary or explanatory information from management.

Management provides information to the Board on an ongoing basis, including minutes of key management committee meetings, to allow the Board to effectively discharge its responsibilities. This includes an annual update on the Environmental, Social, and Governance (ESG) risks and performance across the portfolio.

The following Board committees, each chaired by a non-executive Director who is independent of management, have been set up with specific delegated authorities:

• Executive Committee

• Audit Committee

• Leadership Development & Compensation Committee

• Risk & Sustainability Committee

Information on the responsibilities and procedures of each Board committee, beyond sustainability, is available in the Temasek Review 2025 and on our corporate website.

Executive Committee (ExCo)

The ExCo has been delegated the authority to approve new investment and divestment decisions up to a defined threshold, beyond which, transactions will be considered by the Board. In making decisions to manage and shape our portfolio, ExCo also takes into account sustainability-related risks and opportunities, where relevant, among others.

Audit Committee (AC)

Comprising only independent directors, the AC supports the Board in its oversight responsibilities by reviewing, among other things, our system of internal controls and processes used for financial reporting, audit, and monitoring compliance with laws and regulations and the Company’s code of ethics and conduct.

The AC is supported by Internal Audit (IA). To ensure its independence, IA reports functionally to the AC and administratively to the office of the CEO of Temasek Holdings. IA has full and unrestricted access to all records, properties, and personnel to effectively perform its functions. IA conducts a comprehensive risk assessment across all aspects of Temasek's operations to formulate a risk-based audit plan. Key control processes, including anti-bribery and anti-corruption as well as compliance with applicable laws, regulations, policies, procedures, and guidelines on ethical business conduct, are incorporated into the respective process scope and audited at least once every three years. IA also undertakes special reviews upon requests from the Board, AC, or senior management.

Leadership Development & Compensation Committee (LDCC)

The LDCC is responsible for recommending Board and management leadership plans to the Temasek Board. These include Board and CEO succession, as well as guidelines and policies on performance measurement and compensation plans. In its deliberations, the LDCC ensures the Board and management exhibit and continuously build upon the broad and diverse skill sets necessary to meet Temasek’s long-term strategic objectives, including the competencies necessary to oversee the organisation’s response to sustainability-related risks and opportunities, including climate-related risks and opportunities. At the Board level, this is done by taking into account the combined skill sets of existing and potential Directors when considering the appointment of new Directors to the Board. Full biographies on our corporate website outline the experience of each Director and demonstrate the Board’s comprehensive expertise to discharge its duties.

Risk & Sustainability Committee (RSC)

The RSC was established to enhance focus on opportunities and risks arising from sustainability trends, including climate change, and other financial, reputational, operational, and cyber risks. The RSC supports the Board in its oversight responsibilities by reviewing, among other things, our portfolio risk appetite and profile, risk management, material sustainability and ESG matters, sustainability strategies, targets, frameworks and policies, as well as key public statements relating to risk, sustainability, and ESG.

The RSC coordinates with other standing Committees of the Board, such as the AC and the LDCC, in its oversight of risk and sustainability matters, where relevant.

Senior Management Oversight

Senior management sets the tone and culture of our institution, leading the delivery of Temasek’s vision and mission.

Our senior management oversees Temasek’s key business strategies and organisational initiatives, including sustainability-related matters. Senior management is supported by the following committees, which are chaired by our CEO and comprise members of senior management:

Strategy, Portfolio and Risk Committee (SPRC)

The SPRC reviews macroeconomic, political, industry, technological, and social trends that provide the context in which new opportunities and risks may arise in both existing and new markets. It also reviews our overall portfolio construction efforts and investment strategies. In so doing, it integrates sustainability-related considerations, including climate change and climate transition planning, in the firm’s strategy, investment, risk, and operational management processes.

Senior Divestment and Investment Committee (SDIC)

The SDIC manages and shapes our portfolio on an ongoing basis and decides on investments and divestments up to the authority limits as delegated by our Board. In its considerations, it also takes into account sustainability-related risks and opportunities.

Senior Management Committee (SMC)

The SMC reviews and sets overall management and organisational policies. It oversees the operationalisation of corporate initiatives and processes within the frameworks and overarching principles approved by the Board. Examples include our sustainability-related policies and initiatives, in addition to our institutional sustainability strategy.

Further information on the responsibilities of each Committee, beyond sustainability, is available in the Temasek Review 2025 and on our corporate website.

Functional Capabilities

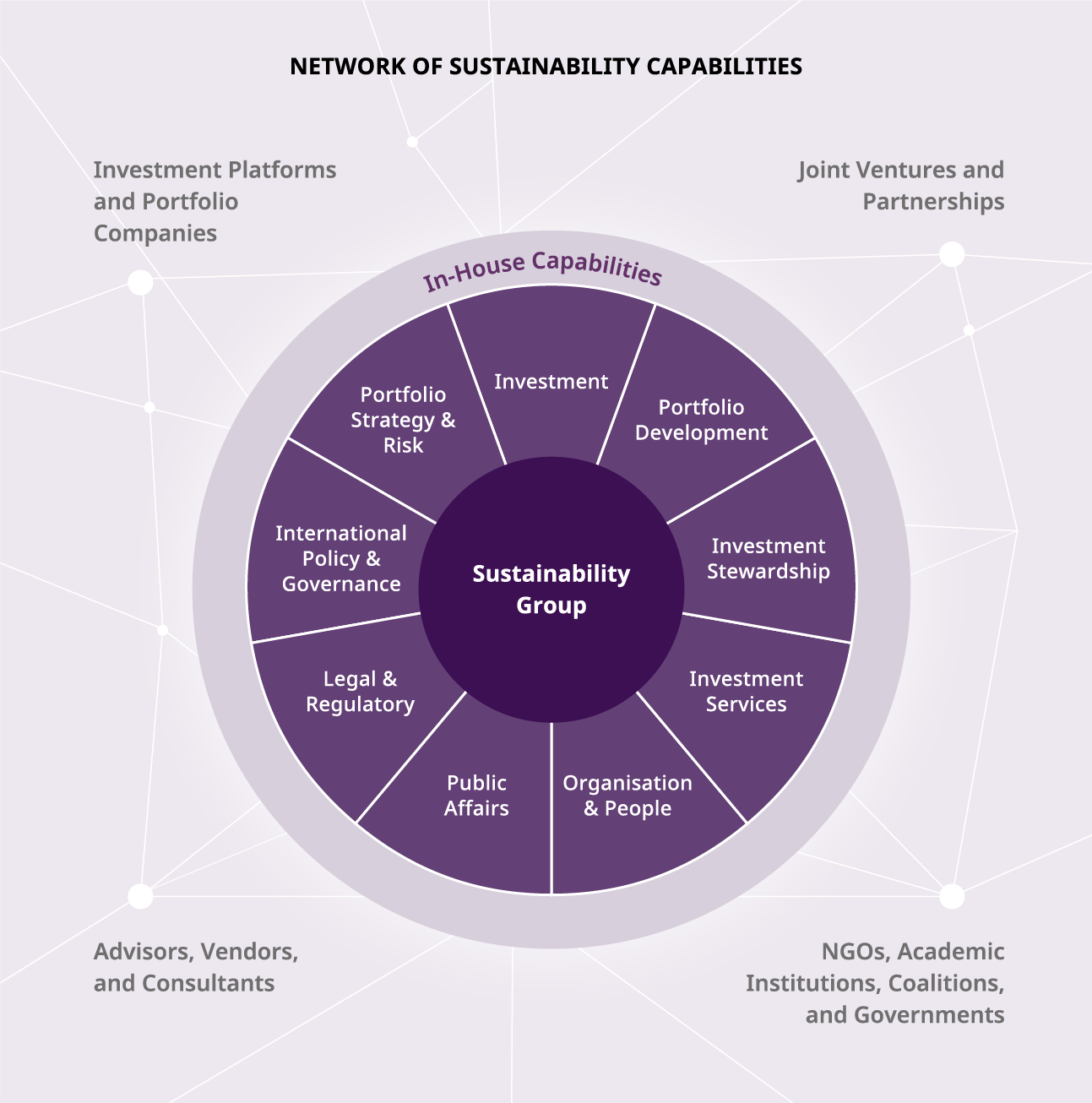

Senior management works with a dedicated team of functional experts supporting the delivery and evolution of our sustainability strategies, frameworks, and programmes.

Reporting to the CEO, our Sustainability Group initiates, develops, and implements our overarching strategy and initiatives on sustainability. As part of its remit, the Sustainability Group partners internal and external stakeholders to catalyse and invest for long-term positive impact, to support the transition to a net zero, nature positive, and socially inclusive world, to build a sustainable organisation, and to collaborate for global progress.

The integration of sustainability considerations across our investment lifecycle is supported by a dedicated ESG Investment Management (ESG IM) function. As part of the Sustainability Group, ESG IM oversees ESG integration efforts pre- and post-investment as well as climate transition readiness. It serves as a centre of knowledge and expertise on ESG issues, partners investment teams to analyse material ESG issues, and engages portfolio companies to build portfolio resilience and uplift ESG practices. This includes identifying and assessing the emission profiles of our portfolio companies.

Through functional experts sitting across various teams, Temasek holds itself accountable to ensuring it has the appropriate skills, competencies, and knowledge to implement its sustainability strategy, including climate transition planning from an asset owner perspective.

Compensation Linked to Sustainability Goals

Our ownership ethos places the institution above the individual, emphasises long term over short term, and aligns employee and shareholder interests over economic cycles. Our compensation framework aims to foster a high-performing and responsible culture, where our employees think and act as owners with a strong sense of intergenerational duty, sharing gains and pains alongside our shareholder.

It balances rewards for short-term performance and long-term value creation. It also aligns our staff towards achieving both our financial performance and carbon emissions reduction targets.

To reinforce the commitment to our carbon emission goals, a portion of our Wealth Added incentive pool is ringfenced to be awarded as a performance-based long-term incentive. The vesting of this incentive is tied to our carbon emissions reduction targets. This aligns our interest to the institutional commitment to halve the net carbon emissions of our portfolio from 2010 levels by 2030, and to achieve net zero carbon emissions by 2050.